Davos, The Dollar, and Donald

America was the go-to investment for global capitalists. Not anymore.

Later today, President Trump will arrive in Davos. Once a year, the quaint Swiss ski town is turned into a capitalist Comic Con for the World Economic Forum’s annual conference. Bankers, politicians, CEOs, and other powerful figures discuss how to grease the wheels of international finance and give a press conference for a global audience. For example, earlier this week, BlackRock’s CEO announced capitalism must “reform” to serve ordinary people, especially with developments in AI. BlackRock also surpassed a record-breaking $700 billion in revenue in 2025, so you can tell that much of what comes out of Davos is more public relations than constructive criticism.

Typically, American presidents are warmly welcomed at the summit. While intra-bourgeois disputes about corporate tax rates and resource access are unavoidable, capitalists love America. After all, this is where they store their money. Or, at least they used to. There have been many ramifications of Donald Trump’s erratic and violent second term. Perhaps most consequential of all is his dismantling of the international economic order, the very foundation of the American Empire.

Since the end of World War II, American hegemony has been upheld by two pillars. The first was the rules-based international order, which respected national sovereignty and aimed to resolve international disputes peacefully. Truthfully, that order never really existed. It was only a façade to facilitate American imperialism. As Grace Blakeley argues here, Donald Trump has destroyed all pretense of the international order and returned geopolitics to a system of might-makes-right.

“The liberal rules-based order is dead. With his invasion of Venezuela, his threats to Greenland, and his trade war, Trump has dealt the final blow to the idea of a global ‘community’ of states, each agreeing to abide by a common set of rules based on respect for free trade, human rights, and sovereignty.” - The Law of the Jungle, Grace Blakeley,

The second pillar of American hegemony was global capitalism. More specifically, the bedrock role the United States played in perpetuating it. As the Allied armies closed on Berlin, their governments met in New Hampshire and established the Bretton Woods system, which set up the International Monetary Fund (IMF) and pegged foreign currencies to the U.S. dollar, which was itself pegged to gold for easy convertibility. Nixon ended gold convertibility in 1971 and ushered in the current era of floating exchange rates, in which currencies have ever-shifting values determined by supply and demand. You can see this system in real life by stopping by the currency exchange booth next time you’re in the airport. While many theorized that decoupling the dollar from gold would weaken America’s financial position, it actually strengthened it significantly, leading to today’s dollar-first system.

“Upon the collapse of the Bretton Woods system, many predicted the end of dollar hegemony and the rise of a multipolar global economic order grounded on more or less even domination of multiple major currencies such as the yen and Deutsche mark. What is puzzling is that this predicted multipolar moment never came, and the dollar hegemony continued for four more decades until today. Even with the formation of the euro as a competitor, the dollar remains the most widely used reserve currency in the world.” - Hegemonic Crisis, Comparative World-Systems, and the Future of Pax Americana, Ho-fung Hung

In addition to making the dollar the de facto global currency, America offered international capitalists the Holy Grail of investing: stability. Over a century of anti-communist oppression has made political threats to American capital few and far between. Violent threats are an even more distant concern. Blessed with two big, beautiful oceans on either side, the United States is less prone to conflict than continental Europe. (This was especially important after World War II, when Europe and Asia were ravaged and unable to guarantee economic stability.) America plays a big role in Eurocentric conflicts such as World War I, World War II, and the Russia-Ukraine War. But the destruction is far away. It’s unlikely American banks will be bombed, or society will devolve into wartime survival, ensuring billion-dollar and trillion-dollar investments are protected.

I agree with Grace Blakeley’s view that the first pillar of American hegemony, the rules-based international order, was hollow. All the Republican Party had to do was swing its Donald Trump-shaped wrecking ball within an inch, and the breeze pushed it over, shattering it into a million pieces. Even Canadian Prime Minister Mark Carney agrees, telling the Davos crowd, “The rules-based order is fading.” But the second pillar, the dollar-first capitalist system, was no mirage. It is very real, and the Trump wrecking ball is careening towards it.

Traditionally, war, conflict, famine, and other geopolitical shocks have led to increased investment in American assets. When the ground starts to shake, international investors turn towards the ever-predictable U.S. dollar and government bonds, driving up their value. Over the weekend, Trump threatened to tariff European nations that deployed troops to Greenland to deter his potential invasion. The threatened nations responded by preparing a tariff package worth $108B. With another global trade war looming (or rather, an increased intensity of the one we’re already in), it’s no surprise the U.S. dollar dropped .9% when the markets opened on Tuesday. (They were closed on MLK Day.) This continues the dollar’s devaluation slide driven by Trump’s second term, which has decreased the currency’s value by approximately 10%. Other stocks also fell, pushing the S&P 500 to its worst drop since October.

If Trump decides on a shooting war rather than a trade war, matters will worsen. Denmark has increased its troop presence in Greenland, bolstered by forces from Germany, Sweden, Norway, Finland, the Netherlands, and the United Kingdom — all officially American allies. The message to Washington is clear: war with Denmark is war with Europe and the dissolution of NATO. But the White House still refuses to rule out a military invasion, setting the stage for a violent — and incredibly stupid — resolution.

No matter if the Great Greenland ShitFest of 2025 is fought with bonds or bombs, international capitalists will no longer see the United States as the default place to invest. With American treasury bonds no longer the safest bet, international investors are putting their money into precious metals. Gold and silver hit record high prices on Monday, at $4,689.39 and $94.08 per ounce, respectively. If Trump follows through on his tariff threat, analysts warn global GDP could fall by almost 3%, with American GDP falling by 1%. This is the exact type of uncertainty and headaches that capitalists avoid like the plague, which is only magnified by Trump’s domestic erraticness.

Earlier this month, Trump’s Department of Justice threatened Federal Reserve Chair Jerome Powell with a criminal indictment over his Senate testimony last year. It’s a clear political prosecution to pressure Powell to cut interest rates, which Donald Trump wants to improve economic metrics. When rates are low, borrowing money is cheap. So, more Americans will purchase homes and cars, making Trump look like a good president. Powell opposes these cuts, arguing that excessive spending can trigger inflation and harm the American economy in the long run. The Federal Reserve (a.k.a., the Fed) is supposed to be an independent organ untainted by political pressure. By trying to make America’s central bank do his bidding, Trump is risking the deterioration of America’s economy. And investors have taken note.

The day after Jerome Powell published a video statement denouncing Trump’s prosecution, the CIO of PIMCO, an American investment management firm, stated that the president’s “unpredictability” was driving them to “diversify” investments outside the United States.

“It’s important to appreciate that this is an administration that’s quite unpredictable. What are we doing about that? We’re diversifying. We do think we’re in a multiyear period of some diversification away from US assets.” - Dan Ivascyn, Chief Investment Officer, PIMCO

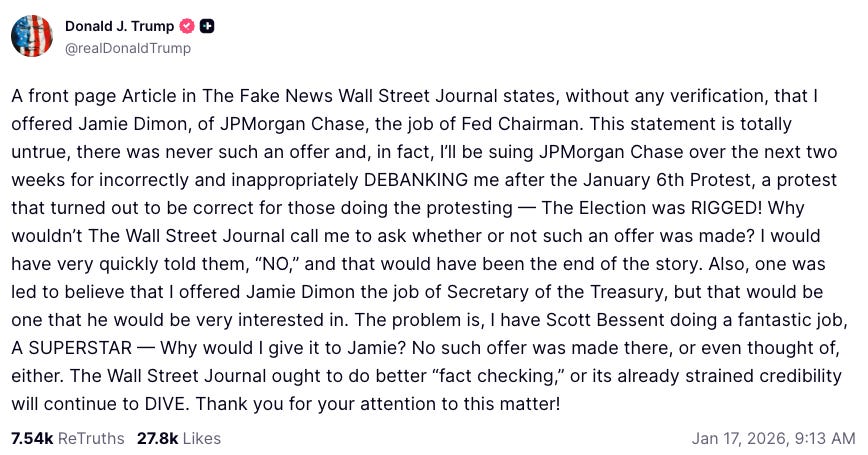

After JPMorgan Chase CEO Jamie Dimon publicly supported Jerome Powell and criticized Trump’s attempts to strip the Federal Reserve of its independence, Trump threatened to sue JPMorgan Chase for allegedly debanking him after the January 6th insurrection. (The conservative obsession with “debanking” is a whole other rabbit hole for another time.)

While Trump’s narcissism has him laser-focused on destroying America’s place as the economic world leader, there’s a question of whether the conservative moment will finally stand up to him. While conservatives swallowed their remaining self-respect to become Trump’s sycophants long ago, shielding the Fed has been the one area they’ve indicated they’ll stand up to him. The Supreme Court has given the president permission to do anything he wants (just as the Constitution says), but they drew a line to deter Trump from messing with the money. After all, Supreme Court Justices have investments, too.

Last spring, the conservative Court ruled in Trump’s favor on Trump v. Wilcox, allowing him to fire appointed members of the National Labor Relations Board and Merit System Protection Board without cause. Justice Kagan correctly pointed out that they were reversing long-standing precedent on behalf of Donald Trump. But the conservatives did make one notable exception to the President’s power. In the ruling, the justices stated that Trump would not be able to fire Federal Reserve officers (i.e., Jerome Powell) without cause, as he could members of the National Labor Relations Board. The case wasn’t even about the Federal Reserve. They included it just to stop him before he started.

“Finally, respondents Gwynne Wilcox and Cathy Harris contend that arguments in this case necessarily implicate the constitutionality of for-cause removal protections for members of the Federal Reserve’s Board of Governors or other members of the Federal Open Market Committee. See Response of Wilcox in Opposition to App. for Stay 2−3, 27−28; Response of Harris in Opposition to App. for Stay 3, 5−6, 16−17, 36, 40. We disagree. The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States.” — Trump v. Wilcox

A few months after this ruling, Trump defied the conservatives and fired Fed Governor Lisa Cook. The Court is hearing oral arguments in this case today, and it’s been reported that Jerome Powell plans to attend in person — a political statement to remind the justices of the Federal Reserve’s long-standing independence from partisan politics. With the heart of global capitalism being the lone line conservatives have warned Trump not to cross, it will be interesting to see whether the justices back down and commit to the ‘Yes Daddy’ theory of jurisprudence, or if they choose to protect the interests of their billionaire backers.

Here is where I must give credit to Donald Trump. With his DOJ arguing he can unilaterally control the Fed in Washington, Trump will be in Davos, where he’s likely to announce his pick for the next chair of the Fed after Powell’s term ends in May. There have been many U.S. Presidents, but I’m unaware of any who has shot himself in both feet while each is on an opposite side of the Atlantic Ocean. It’s not guaranteed he’ll pull it off. But if anyone can, it’s old’ Donny Dealmaker.

Trump’s current front-runners for Fed chair are his lackey, Kevin Hassett, and the “pro-Fed independence pick,” Kevin Warsh. It’s fair to say Hassett is the favorite, but even if the more traditional Warsh is tapped, it’s too late to unring the bell singing the death knell of America’s unparalleled financial position.

I’m not one to cry over the devaluation of U.S. government bonds, or even a decoupling of European and American military interests. The U.S.’s former position as capitalism’s home base and arbiter of who gets to invade whom has led to a decreased quality of life for Americans and our foreign brethren alike. Washington has shown no hesitation in slaughtering millions of non-Americans for electing a moderately left-wing government, and the concentration of capitalist wealth has made Wall Street and Big Tech the deciding factor in American elections. That said, bombing Greenland and taxing American citizens because you’re mad Norway for not giving you the fucking Nobel Peace Prize is not the method of change I would have suggested.

The great irony here is that capitalists and the Republican Party have worked hand-in-glove over the last century to ensure the United States’ capitalist dominance remained unchallenged. They toppled democratic governments and shredded every civil liberty in the Constitution to destroy any threat to corporate profit margins. That was very popular with the American people, so they had to gain support by yelling about trans girls playing badminton and the Cracker Barrel logo. Conservatives became so enthralled by their rage-baiting Twitter threads and Free Thinking podcasts (where they all said the same thing) that they forgot what their goal was. Now, the anti-gender president is single-handedly destroying America’s place as the Emperor of international capitalism.

There’s no telling where the pieces will fall or what the world will look like once the dust clears. But one thing I do know is they’re throwing one hell of a party in Beijing.

Thank you for reading JoeWrote. Please tap the ❤️ before you go, and remember to subscribe if you’re a first-time reader. If you’re a returning reader, consider a JoeWrote supporting subscription. It costs only one cup of coffee a month and ensures I can keep writing articles like this that help us better understand the world. Thanks in advance!

In Solidarity — Joe

The expression of a malignant narcissist Trump full of lies, nonsense, threats, and self-praise made me want to vomit.full of lies, nonsense, threats, and self-praise made me want to vomit.