Welcome to JoeWrote! This post is public, so feel free to share it. If you’d like to support JoeWrote, as well as access everything I have to offer, please consider a free or paid subscription.

I appreciate the support. Enjoy! - Joe

Much to my chagrin, the American Right is very good at messaging. So good that their core theses — taxes are theft and companies are the property of their owner — are taken as certainties by average Americans and adopted as core principals for both major political parties.

But like most instances of messaging, this view is overly simplistic, presenting a distorted picture of how wealth and value are created while ignoring key facts that disprove its core tenets. To believe taxes are theft is to attempt to parse the value created by an individual or business from the public goods and services that enabled them to make that wealth. This is impossible, and no more ridiculous than trying to attribute one’s success to a specific part of the human body, while it is common knowledge that every limb and organ contributed to some degree.

Taxes Aren’t Theft…

Through the Right Wing’s framing, taxes are no different than any other kind of coerced theft. Just like a mafia boss demands a cut from businesses operating in their territory, the U.S. government takes a sizable percentage of your money only to waste it on excess and the bowels of bureaucracy. To be fair, few Conservatives advocate for the abolition of all taxes, as they appreciate the military, police, and other entrenched government programs. But they still rally against taxes with the goal of courting the public to their project of constricting the government’s ability to expand expensive social insurance programs.

But to believe taxes are theft requires an incomplete view of how society operates, one that subscribes to the farce that an individual’s financial success can be detached from the contributions of the collective. It cannot, as without the public services and goods provided by society, all business activity would cease overnight.

For example, every business is dependent on the public education system, as they need workers who can read, write, and count in order to complete even the most trivial production tasks. According to the Bureau of Transportation Statistics, of the total value of goods shipped domestically in 2022, 75% of it was moved on roads built and maintained by the American public. Were these roads not to exist, or the American public decide to stop funding their upkeep, commerce would decrease and investors would panic.

The same can be said about the fire departments that protect storefronts, the anti-monopoly practices that enable small businesses to flourish, and the anti-poverty measures that decrease crime and allow customers to mosey down Main Street without fear of being robbed.

But business’s dependence on society isn’t limited to what has already been created. Roads, schools, fire departments, and other public entities are key facilitators of private commerce. Still, they pale in comparison to the importance of the legal apparatus that is the United States Government.

Businesses make money through contracts. Sometimes these contracts are gargantuan, such as the land lease of an Amazon warehouse, and sometimes they are imperceivable, such as your agreement to pay the listed price for a gallon of gas every time you fill up your car. But whether their contracts are big or small, businesses are only able to operate because they know their contracts will be enforced by the government. If the U.S. state did not exist, businesses wouldn’t be able to operate as there’s no guarantee other parties would be held responsible for payments. This means that when a business conducts deals in 2023, it is doing so with the full faith that the taxpayers of 2033 will still be funding the local, state, and federal governments they need to hold the other parties accountable. Without the support of the American people, private businesses wouldn’t be able to sell so much as a candy bar, never mind entire plots of land.

When all is said and done, it is impossible to separate the value created by the business owner from the value created by the citizens who enable the business to exist. Despite the notion that a businessperson is solely responsible for their wealth, and therefore should get to keep it without it being “stolen” through taxation, that wealth only exists because they made it through the systems and channels raised by all of us. Were these systems not to exist, businesses wouldn’t be able to make $1 in revenue. At the end of the day, taxes are merely society’s return on investment. They are the percentage a nation’s people take for investing in the tangible and intangible infrastructure that enabled businesses to operate and Capitalists to profit.

To call taxes “theft” is devoid of reason. But there is something else that justifies that label…

But Profit Is.

When we understand how society’s collective input is the foundation for even the most elementary financial success, the nature of profit becomes very clear.

To clarify our terms, “profit” is not the same thing as “making money.” A worker who is paid a wage for their labor doesn’t “profit.” That privilege belongs to the business’s owner, who sells the products or services created by the workers for more than the worker was paid in wages. The difference between what the worker’s product sells for and what they are paid is called profit, which under a Capitalist structure, is the property of the owner.

As detailed above, not $1 can be made without utilizing the public goods and services provided by the American people. Here we see how profiting — the act of taking that money out of the system that created it — is to steal from society (including the workers who are paid less than their work is worth).

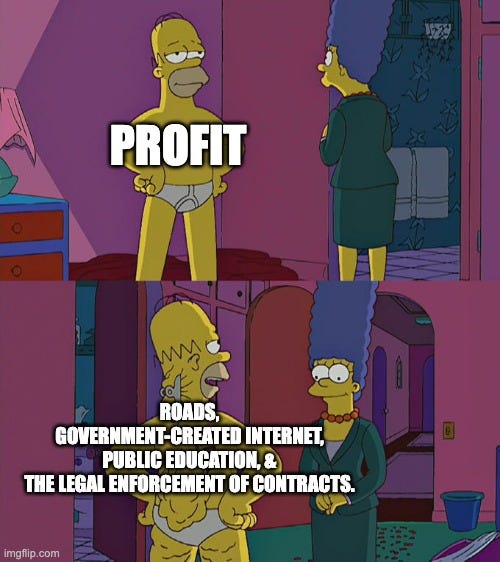

To make profits, a entrepreneur Capitalist will open a shop, employ workers educated by the state, ship goods over public roads, find customers over the government-created internet, have their buildings protected by public servants, and most importantly, have the United States Government enforce their contracts so they can operate indefinitely. Then the Capitalist reaps the revenue this system enabled, pays their workers a fraction of what they’re worth, and decries those who wish to tax back their profit as “entitled.”

What the Capitalist has just done is utilize the collective will of the American people to create value, then they have extracted that value from society for the purpose of their own enrichment.

As taking something they did not create is obviously akin to theft, it is well within society’s rights to tax this wealth back based on a scale proportional to the amount of profit. In fact, considering the wealth was extracted from the public and the workers in the first place, it is logical that we should be working towards an economic system in which there is no profit. By eliminating the act of removing value from the system, we can build an economy that distributes the value society creates back into itself efficiently and without pervasiveness.

Thanks for reading! If this is your first time here make sure you subscribe so future articles are delivered straight to your inbox.

And don’t forget to share your thoughts about my argument in the comments. Do you think taxes are theft? Why, or why not? What about profit? I look forward to hearing your thoughts. - Joe

One thing I didn't have the space to cover was the role of taxes on the working class, and how its different from taxing Capitalists and owners. Though they are very different in theory from taxes on profit, I still believe they are important to fund important social programs.