Flying Sucks. A Public Airline Can Fix It.

A white paper on the problems and solutions to air travel.

Hey readers, I’ve got something different for you today. This is a white paper I wrote a few months ago for a scholastic journal. We weren’t able to place it, but given the recent air travel catastrophes, I figure now is a great time to publish it. While most of my articles are short explainers, this is much longer. Feel free to read it in segments and come back to it when you have the focus.

Full transparency — I’m releasing this for premium readers, but I plan to unlock it for all readers at a later date. The argument is solid, so I’d like to expand its reach to show Americans how we can restructure our economy for the better.

That said, I still need financial support to continue writing. If you appreciate this article, please consider becoming a paid subscriber for whatever price fits your budget.

In Solidarity — Joe

In a country as polarized as the United States, it’s rare to find issues the public agrees on. Perhaps the last shared belief among Americans is that flying is a uniquely unpleasant experience. Just 27% of polled Americans[1] have a positive view of the airline industry, and J.D. Power’s 2023 North American Airline Satisfaction Survey[2] found passenger satisfaction fell for the second year in a row. Unsurprisingly, high prices, seat discomfort, and airlines’ callous responses to delays and cancellations are the primary complaints.

Then there are the safety concerns. In early January, an Alaska Airlines flight was forced to make an emergency landing after the fuselage was blown open. The images of the gaping hole circulated online and through the media, frightening millions. The FAA ordered a grounding of similar plane models until they could pass safety checks. During the checks, Alaska Airlines reported that “many” of their planes had loose bolts like the one that caused the disaster, a natural outcome of the industry’s decades of deregulation and labor cuts.

With near universal dissatisfaction with the current state of flying, it’s time for America to consider an alternative model that foregoes profit-seeking in favor of efficiency, cost, and safety.

The Problems with For-Profit Air Travel

There’s no grand mystery as to why modern air travel is so atrocious. As for-profit companies, airlines are incentivized to charge high fares, price gouge during the holidays, squish passengers into cramped spaces, and surprise travelers with unexpected fees. Unlike public transportation, air travel is a business. As the United States is a large country with no established high-speed rail, flying is the only method most Americans have to traverse the nation promptly. Airlines know this and respond as any for-profit institution would: by nickel and dimming passengers for every cent they’re worth.

According to the theory of free-market capitalists, passengers are free to escape the poor experience of one airline by taking their business elsewhere. As the guiding doctrine of American economics goes, if customers don’t like the services or prices provided by one company (in this case an airline) they will naturally migrate to a competitor, eventually rewarding the “good” provider and putting the “bad” provider out of business. But, as evident by the fact that every major airline engages in the predatory practices Americas despise, it is clear that the free-market theory does not work for the air travel industry.

Though there are many industries in which capitalist doctrine fails to meet reality, air travel is chief among them for the simple fact that airliners operate as a cartel. The 21st century has seen an increased rate of airline mergers, resulting in the four largest U.S. airlines — American, Delta, United, and Southwest — accounting for over 80% of all domestic airborne traffic.[3] With so few competitors and a very steep barrier to entry, it is relatively easy for these four companies (nicknamed “The Big Four”) to undertake trust-like behavior, which they do brazenly. After attending the 2015 International Air Transport Association (IATA) meeting, the annual congregation of top airline executives, New York Times correspondent James B. Stewart reported the airline execs had openly expressed a shared commitment to staying “disciplined,” a term he described as “classic oligopoly-speak.”[4] In this particular IATA meeting, the major airlines came together to function as would a cartel; they discussed agreements to limit passenger capacity, keep ticket prices high, limit competitive prices, and other practices in vague language that gives plausible deniability that they’re breaching anti-monopoly laws. As antitrust professor Christopher Sagers put it at the time, “They (the airline executives) are all but saying you (the other airlines) need to limit output to keep up prices.”[5]

Airlines can behave in this anti-competitive manner largely because there are so few of them. The lack of air travel options isn’t due to little interest from would-be competitors, but rather the high rate of mergers that airlines have undergone in the past few decades. According to the American Business History Center[6], in 1975 there were approximately 20 major airlines for Americans to choose from. By 1990 there were 13, by 2005 there were 10, and by 2019 there were only 8 — Delta, United, American, Southwest, JetBlue, Alaska, Spirit, and Frontier. For the most part, these are the only flight choices Americans have today. While some airlines went out of business in the last half-century, this limited number of competitors is mainly due to airline mergers, which has left the industry with shockingly few providers. Just since President Obama took office, there have been 17 attempted airline mergers, only one of which was blocked (Frontier and Spirit’s attempted merger was blocked by the Biden Administration in 2022). To make matters worse, the number of current competitors is at risk of decreasing, as the low-cost airlines JetBlue and Spirit, both of which put downward price pressure on “The Big Four” are attempting to merge. (A District Court recently blocked this merger, but the companies are set to appeal.) From the viewpoint of the average American, the end result of the air industry’s proclivity to mergers is a one-two punch. First, the relatively low number of competitors that exist in the space makes it much easier to engage in the cartellian behavior, like that of the aforementioned IATA meeting. As the airline executives put it, it’s much easier for them to keep eight companies “disciplined” than twenty.

Second, fewer airline options mean less competition and higher prices for the consumer. The same year as James Stewart’s report on trust-like language being used at the IATA meeting, Dr. Fiona Scott Morton, the former Deputy Assistant Attorney General for Economic Analysis for the Antitrust Division at the U.S. Department of Justice, authored a white paper analyzing the anti-competitive behavior of airlines[7]. In her research, Dr. Morton found that when fuel prices declined by over 25% in 2014, airfares remained flat. While fee-market theory would have us believe the reduction in fuel costs would drive airlines to reduce their prices to get an edge over their competitors, they did not. Instead, the airlines agreed to keep prices consistent, pocketing the savings and increasing their revenue by $15 billion. Additionally, Dr. Morton found that, unlike producers of other consumer products, such as books, life insurance, and automobiles, airlines were increasingly hesitant to share their prices and schedule information with websites that help consumers compare flight options. (These travel sites are proven to foster competition and improve consumer welfare.) Morton estimated the consumer cost of these restrictions to exceed $6 billion a year[8] and likely deterred up to 41 million passengers from flying. To this day, major airlines still withhold information from these sites, as Southwest Airlines keeps its information off of Google Flights, Expedia, and other online travel agencies[9], hampering competition and costing would-be passengers millions.

Another example of the cartellian nature of airlines can be seen in the ongoing episode of the Northeast Alliance, the name for the quasi-merger between JetBlue and American Airlines in the American Northeast. Citing the market dominance of Delta and United in the New England and Mid-Atlantic regions, JetBlue and American entered into the partnership in 2020[10] under the permission of the Trump administration. By sharing schedules, gates, planes, employees, flight data, and even passenger programs such as bonus flight miles, JetBlue and American operated as a de-facto consolidated company in the airports of Boston, New York, and New Jersey. In September of 2021[11], the Biden Administration filed an anti-competitive lawsuit against the airlines, saying the Northeast Alliance harmed competition. On May 19, 2023, the judge ruled in favor of the Department of Justice[12], claiming the Alliance violated the 1890 Sherman Antitrust Act by “substantially diminishing competition… among the most significant competitors in that (Northeast) region.” JetBlue and American were given 30 days to “unwind” the Alliance, though American Airlines has already filed an appeal. JetBlue has not joined in appealing the decision, likely because it hopes to quell concerns about its proposed merger with Spirit Airlines.[13] The Department of Justice has already filed suit to block that merger, with the trial scheduled for October of 2023. Regardless of whether or not American Airlines’ appeal is denied or the JetBlue-Spirit merger is blocked, the ongoing desire for airlines to merge, taken in conjunction with the long history of airline consolidation, shows that the for-profit air travel industry has an inherent anti-competitive characteristic, which will not subside until the profit motive is removed from its operation.

But anti-competitiveness and the poor treatment of customers are not the only reasons Americans should democratize the air travel industry. In addition to the ails plaguing the consumer, capitalist air travel produces unnecessary emissions that harm the planet. With the damage done by climate change growing worse every year, humanity must do everything within our power to reduce carbon emissions. While creating a 100% environmentally sustainable society will take time, replacing capital’s disregard for its environmental impacts with an environmentally-conscious owner (i.e., the American people) is a low-hanging fruit that should be seized immediately.

One of the most environmentally damaging practices undertaken by capitalist airlines is “ghost flights,” passenger-less flights conducted only to preserve airport gate spots. Because airlines bid on gates years in advance, they often wind up with unneeded spots. As airports operate on a “use it or lose it” rule,[14] which forfeits an airline’s spots the year after they don’t use a certain percentage, airlines go through the motions of flying from one destination to another with deserted planes (anything less than 10% capacity[15] is considered a “ghost flight”), just to satisfy their quota. As these empty flights serve no material benefit to the average traveler (in fact, they likely worsen the air travel experience by taking up a gate that could be used by a full plane) their only output is emitting unnecessary CO2. And though their environmental damage far outweighs the nonexistent benefit they provide, as ghost flights protect the airlines’ profit margin, they will remain as long as capitalists control the air travel industry. Not only is taking up unnecessary space on crowded runways an offense on its own, but given how air travel contributes to over 4% of human-induced climate change[16], the practice of flying empty planes compounds the damage done by an already destructive industry.

Bringing airlines under state control will put the United States in the proper position to facilitate the transformation to a much more efficient, cost-effective, and environmentally friendly transportation system. By shifting the paradigm of cross-continental travel from one of private ownership to one of state control, with the explicit goal of preserving the environment and improving the consumer experience, the nationalization of airlines will lay the groundwork for the United States to construct a high-speed rail system to work in conjunction with its airborne counterparts. Private air travel is inherently wasteful in the regard that if a customer base is willing to pay for a flight, the airline will offer it, even if it is ridiculously short and not at all worth the environmental damage.

For example, United, Southwest, and American Airlines all offer flights from Denver, CO to Colorado Springs, a city just 70 miles away. While one could drive this journey in little over an hour, major airlines offer 45-minute flights for $400, which emit up to 72 kg of CO2 per passenger.[17] Some airlines even offer Rube Goldberg-style transit, with a layover in Dallas Fort Worth airport, a nine-hour trip that generates almost 200 kg of CO2 per passenger. Comparatively, driving from Denver to Colorado Springs would emit only about 30% of the CO2 levels of the direct flight (21.5 kg)[18], per passenger. Were the United States to build a rail system comparable to the Eurostar railway, this 70-mile journey would produce about .672 kgs of CO2 per passenger[19], a fraction of the emissions being produced by airlines. Similar examples of waste can be found on air routes across the country. Much of the travel in the compact North East between the cities of Boston, Providence, New York, and New Jersey could be traversed much more efficiently with a high-speed rail system, with regards to both the environmental impact and the ease of travel. With air travel notoriously uncomfortable, more and more European travelers, who have a choice between flying and riding the rail, are opting for the latter. According to the Barcelona-based travel company TravelPerk, there were 52% more train journeys booked than flights[20] during the fourth quarter of 2022 compared to the same period in 2019, indicating a strong preference for the eco-friendly method of travel.

While the creation of a high-speed railway is not directly necessary for the project of nationalizing the airlines, the two go hand in hand. As the American government taking control of air travel would facilitate efficient, pleasant, and environmentally optimal travel across the country, instituting state-run rail travel is an obvious way to reach this goal. For any actor, whether it be a capitalist company or a national government, to try and create an efficient travel system without including a robust rail network would prevent their project from finding success. As the goal of airline nationalization is to improve upon the capitalist version, not simply replicate it under a different name, building out a complete national transportation system should become a subsequent priority for any government that seeks to nationalize the airlines.

If one is not convinced that the consumer pains, environmental damage, and anticompetitive issues caused by capitalist ownership are enough to warrant state ownership in the air travel industry, then a simple examination of the historic performance of these companies should be more than enough to change their mind. Already twice this century, the U.S. government has had to save the airlines from financial collapse. The first bailout came just weeks after 9/11. To keep the airlines solvent until Americans felt safe getting back on a plane, Congress passed the Air Transportation Safety and Stabilization Act[21], which provided major airline companies with over $25.8 billion[22], in 2023 dollars. Less than two decades later, these same airlines would receive an even larger bailout to keep them above water during the COVID-caused recession, which hit the travel industry especially hard. As part of the government’s Payroll Support Program, the air travel industry as a whole received over $63 billion in U.S. taxpayer funding[23], with $54 billion going to passenger airliners ($4 billion went to cargo airliners, while aviation contractors received $5 billion). Naturally, “The Big Four” received the most: American Airlines received $12.8 billion, Delta Air Lines received $11.9 billion, United Airlines received $10.9 billion, and Southwest Airlines received $7.1 billion. Alaska Airlines and JetBlue received over $2 billion each, Skywest got just under a billion, Spirit received three-quarters of a billion, and Hawaiian got six-hundred and seventy-three million. (Sky Chefs Inc., a major supplier of both pre-packaged and catered airplane food, received just under half a billion dollars.) Even more troubling than the gargantuan amount given to these for-profit companies was the requirement that only 26.2% of the $54 billion (about $14 billion) must be repaid[24]. That means that these capitalist airline companies, which squeeze their passengers for every cent they can get, were gifted approximately $40 billion from the U.S. taxpayers, who received nothing in return. Absent this public investment, the airlines would have collapsed. As stated by American Airlines CEO Doug Parker, “It’s no exaggeration to say the (bailout) program saved the industry.”

When added together, between 2001 and 2020, the air travel industry received over $79.9 billion from American taxpayers, adjusted to 2023 dollars. (That figure climbs to $88.8 billion if we include the money given to cargo airliners and aviation contractors.) Not only does the repeated need for public funding indicate the need for public ownership of the airlines, but it is even more apparent when the funds they’ve received is put up against their total worth. At the time of writing, the market cap of the four major airlines is as follows: United Airlines is worth $18.89 billion, Delta Airlines is worth $31.24 billion, Southwest Airlines is worth $22.17 billion, and American Airlines is worth $11.37 billion. Cumulatively, these companies are worth $83.67 billion, just $3.77 billion more than what they have received in taxpayer bailouts since 2001. As it is foreseeable that one or more of these companies will require financial assistance from the government at some point in the near future, the air travel industry will likely be bailed out with more than it’s worth sometime in the coming decades.

Instead of continuing to enable the exploitation of workers and passengers so that capitalists may make a profit without the risk of market failure, it is much more fiscally and socially responsible for the United States government to begin the process of nationalizing these companies to solve the problems caused by the for-profit model of air travel.

The Solutions

As each of the aforementioned problems — the mistreatment of passengers, airlines functioning as a cartel, unnecessary environmental harm, and the repeated need to be bailed out — all stem from the for-profit motive, the solution to these problems is simple: remove the profit motive from air travel. The best way to do that is for the United States government to nationalize existing airlines and operate them as a state-owned enterprise (SOE).

Were the U.S. government to begin operating an airline as a public good, the pains facing passengers today would be severely reduced if not eliminated. With a mission to facilitate affordable and effective air travel with minimal harm to the planet, a publicly-owned airline would have no incentive to hit passengers with surprise fees, charge exorbitant prices for water and peanuts, or conduct any of the other profiteering activities that cause the public to despise capitalist airlines. Just as no one is trying to upsell passengers on a city bus, a state-run airline can forget about trying to maximize profit and instead focus on delivering high-quality service.

Additionally, similar to how instituting a public option for health insurance would reduce the costs of private healthcare plans[25], the creation of a public airline would place downward pressure on the existing for-profit airlines, reducing fares and mitigating the anti-competitive behavior the industry is known for. For example, had a public airline been in place in 2014 when oil prices fell by 25%, it could have passed these savings on to the American people by lowering its airfares in proportion to its lower costs. This would have forced the for-profit airlines to decrease their prices as well, or risk being out-competed by the SOE. But as we know, there was no public airline in 2014, so capitalist owners kept prices artificially high, funneling all the potential savings of lower fuel costs into their profit margins.

Not only would the creation of a public airline curtail existing monopolistic activity and make flying more amicable for the average American, but it would be the first step in altering our current travel practices to fit the needs of a society creeping increasingly close to climate catastrophe. As put by the prominent capitalist economist Milton Friedman, “The social responsibility of a business is to increase its profits.[26]” This widely accepted mantra, known as “The Friedman Doctrine,” encapsulates why capitalist airlines can't curtail the damage they are doing to the climate. Their sole concern is to maximize profits. As emitting unnecessary CO2 enables that goal, they will keep doing it, ozone layer be damned. Airlines are well aware[27] of the outsized damage they are doing, and yet, as evidenced by the fact that you can right now book a high-emission flight from Denver to Colorado Springs, they are unwilling to take any measure that could reduce their profits. In addition to replacing short-distance flights with other modes of public transportation, ghost flights, the passenger-less flights designed to save gates at airports, would not be practiced by an airline under public control. And though not spending fuel on pointless flights seems like an obvious step for a society facing environmental collapse to take, such a simple remedy is impossible under the capitalist model. Were a CEO of one of The Big Four to tell shareholders that they were going to institute a flight model that reduced emissions and revenue, they would immediately be ousted and replaced. This is exactly what happened to Emmanuel Faber, the CEO of Danone, a food producer worth over $36 billion. After attempting to make the company more environmentally sustainable, Faber was ousted in 2021 by investors[28].

The inability of capital to care about anything except profit, even in the face of climate disaster, is why public ownership of the airlines is the only viable option for helping our society transition to become environmentally sustainable. As previously mentioned, the operation of a state-owned airline should come as part of a nationwide project to reduce carbon emissions across the board. Following airline nationalization, the development of a high-speed rail system (HSR) would need to be a top priority. Compared to countries of comparable development to the U.S., our HSR is shockingly spare. According to the Environmental and Energy Study Institute[29], the U.S. has approximately 54 kilometers of high-speed rail, compared to 26,869 kilometers in China. Countries with much smaller landmasses also surpass the U.S. in rail lengths, such as Spain (3,100), Japan (3,041), Germany (3,038), and the United Kingdom (1,377). As the development of high-speed rail in these peer countries shows, it is not a question of if this method of environmentally-friendly travel could be built, but whether or not the United States chooses to build it. When used in conjunction with a fast and accessible high-speed rail system, a publicly-owned airline would be just one part of the United States’ push toward creating an environmentally sustainable society.

If one is still unconvinced of the need for the U.S. government to become involved in the air travel industry, the issue of fiscal responsibility is sure to sway them. As previously discussed, consumer air travel companies have received approximately $79.8 billion from American taxpayers since the start of the century ($25.8 billion in 2001 and $54 billion in 2020). As the for-profit airlines have required a bailout in both of the decades that have occurred this millennium, it is not unreasonable to think that they will require another one in the foreseeable future. And, if that were to be the case, that would likely bring the total amount of taxpayer dollars spent on these for-profit companies above their total value of $83.7 billion. In this very plausible scenario, American taxpayers would have paid more than the airlines were worth, only to be continuously exploited and dehumanized every time they fly.

Instead of continuing the pattern of bailout, crash, bailout, the U.S. government would be wise to begin bringing airlines under public control. While a public-controlled airline wouldn’t be unimpacted by a world-altering terrorist attack or pandemic, as for-profit actors turn to the government for fiscal support after these events, nationalizing the airlines would remove the waste of the for-profit model. Fortunately, state ownership of airlines is not a hypothetical solution, but a very real practice with a global precedent for success.

How It Would Work

While the concept of state-owned enterprises (SOEs) is foreign to most Americans, especially in the context of air travel, state-run airlines are quite common in other nations. By pointing to these public companies as proof that the United States could operate its own airline, the government would be able to simultaneously convince the American public that public ownership of airlines would work to their benefit while using the existing airline SOEs as a model to build its own.

While there’s no shortage of airlines owned by nation-state governments, some of the most successful include those owned by the governments of New Zealand (Air New Zealand[30]), Finland (Finnair[31]), Malaysia (Malaysian Airlines[32]), and China (the Chinese government holds majority ownership[33] of seven airlines and a minority stake in three), just to name a few. While the Malaysian government is the only of these nations to own the entirety of its airline, the rest hold majority stakes that give them, and the people they represent, control over the airlines’ operations. The New Zealand government owns 51% of Air New Zealand, the Finnish Prime Minister’s Office owns 55% of Finnair, and the Chinese government owns a majority stake in Air China, Air Macau, Beijing Airlines, Henan Airlines, Kunming Airlines, and Shenzhen Airlines through its state-owned holding company, the China National Aviation Holding Company (CNAH). CNAH also holds a minority stake in Cathay Pacific, the Shandong Airlines Group, and Tibet Airlines. While larger portions of state ownership will always be ideal, what is important to recognize here is that it is no coincidence that the governments have made it a point to acquire controlling interests in these companies. While the outstanding minority stock is bought and sold on global stock exchanges, the control of the airlines remains the exclusive prerogative of the people of these nations. Furthermore, these SOEs are not small, “boutique” airlines that only carry a few thousand passengers a year. In the pre-COVID years, Air New Zealand conducted over 3,400 flights every week, carrying over 17 million passengers annually[34]. Finnair carried 9.1 million passengers in 2022, showing a strong rebound from the COVID decline. The Air China Group, the largest of these state-run airlines, carried over 115 million passengers in 2019[35].

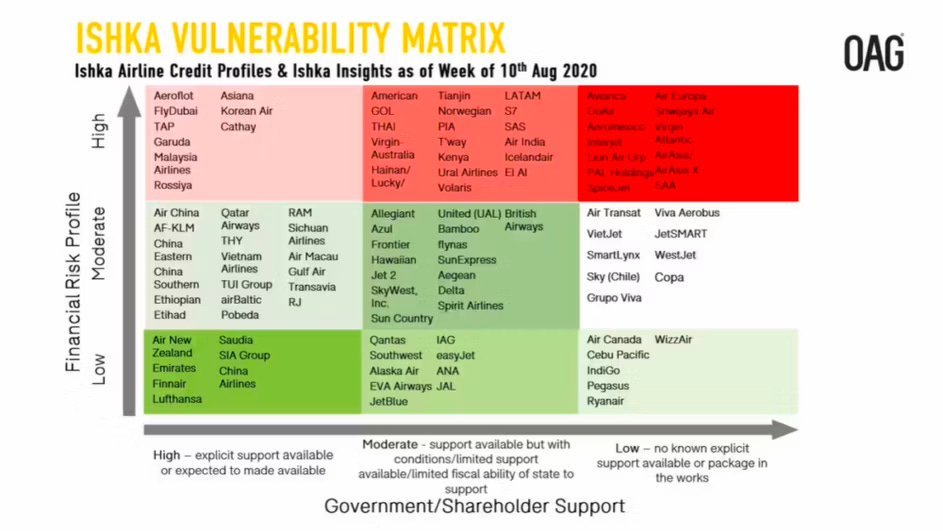

And while even state-owned airlines are not invulnerable to financial hardships, they are much better positioned to weather the financial calamities that destroy for-profit airlines. Back in 2020, the airline data analysis companies ISHKA and OAG created a “vulnerability matrix”[36] to gauge the risk levels facing each airline. The “safest” group was comprised exclusively of state-owned airlines, specifically Air New Zealand, Emirates, Finnair, Lufthansa, Saudi Airlines, Singapore Airlines, and China Airlines. While each of these airlines is of a different size and operates in different regions, they all share one defining feature: a high degree of state ownership, which helped them endure the COVID recession that caused for-profit airlines to ask for bailouts.

With the ability of a government to operate an airline well proven by airline SOEs around the world (as well as the repeated failure of capitalist airlines here in the U.S.), we can now address how the U.S. government would go about building its own state-owned airline. Once Congress has incorporated an SOE to manage the airline, there are three possible approaches for the U.S. to build its fleet and start providing travel services to passengers. It should be noted that these methods are not mutually exclusive, but rather can be used in conjunction to create the optimal outcome.

First, the government could build an airline from the ground up. Just as it built its Air Force, this method would see the government create a civilian version by purchasing planes from manufacturers, hiring pilots and crews, and ramping up operations just like any other private enterprise.

Second, the government could purchase the publicly traded stock of existing airline companies, no different than if they were purchased by a private company. Once it acquired a majority of the shares, the U.S. government could use its controlling votes to change the airline practices for the better, eliminating ghost flights, reducing fares, and providing Americans a travel option absent ruthless profiteering.

The third tactic, which is most likely given the historic financial troubles airlines have faced, is to purchase airline stock during periods of financial trouble. Had this approach been taken in 2001 and 2020, the U.S. taxpayers would own around $80 billion worth of stock in the major airlines, instead of the current situation, in which they own nothing. Furthermore, the U.S. government has experience in this practice. As part of the 2009 Troubled Assets Relief Program, as an effort to prevent General Motors from going bankrupt during the Great Recession, the government purchased 60.8% of General Motors for $49.5 billion [37]. The stock was eventually sold in 2013 for a loss of $10.7 billion, but by then General Motors had been saved from bankruptcy. The case of General Motors provides an interesting example in the context of nationalizing airlines, as it proves the U.S. government is more than capable of running a corporation that was previously privately held. By holding ownership for four years, the government took General Motors from a failing company with a stock price below $1[38] up to a $41.85 stock price at the time of the sale[39]. Concerning both automobiles and airplanes, the U.S. government has proven that it is more than capable of operating industrial entities crucial to the continuance of American life.

(I wrote about the government ownership of General Motors, here.)

While the first method would see the creation of an entirely state-owned airline from the ground up, methods two and three would provide the government the choice between acquiring one airline in its entirety or taking partial ownership in multiple airlines. (Granted, in the event of severe financial disaster, the airlines would likely go bankrupt, enabling the government to acquire them all for pennies on the dollar.) Given the current problems plaguing the air travel industry, specifically with regard to the mistreatment of passengers and the anti-competitive nature of the industry, it is the belief of this paper that the government should focus on acquiring one airline to begin with so that it may begin putting competitive pressure on the for-profit airlines, driving down prices and incentivizing a stop to the monopolistic, predatory behavior. As the IATA speaker said back in 2015, the airlines seek industrial “discipline” so they can continue price fixing. A public airline would be “undisciplined,” busting the aviation trust and giving the American public a cost-effective means to fly. This is not to say that the government should focus only on one airline, but rather start by acquiring one and gradually bring the others under public control. As previously mentioned, the damage done to the environment by private airlines means it will be necessary to eventually take total or partial ownership of those entities to eliminate ghost flights, end short-distance flights, and ramp up the development of other forms of transportation, namely high-speed rail, which the air industry is known to lobby against[40].

Whether discussing a single company or the entire industry, the nationalization of airlines is a policy removed from the American political discourse. But, as evidenced by the chronic problems of for-profit travel, which harm passengers, taxpayers, and the planet, the current model is both inefficient and unsustainable. By emulating what many other nations have done in taking ownership of their major airlines, the United States government could drastically improve the travel experience and lives of millions of Americans while simultaneously taking the first steps to build an environmentally sustainable travel system, and eventually, an environmentally sustainable society.

Thank you for reading JoeWrote. Don’t forget to comment, like (click the❤️ button), and subscribe so you don’t miss a future article.

[1] "Airlines." News.Gallup.Com, 22 Aug. 2022, news.gallup.com/poll/1579/airlines.aspx.

[2] Street, Francesa. "US Airline Passengers Are Getting Increasingly Frustrated. Here's Why." CNN.Com, 10 May 2023, www.cnn.com/Travel/Article/Jd-power-2023-north-american-airline-satisfaction-survey-results/Index.Html.

[3] Scott Morton, Dr Fiona, et al. "Benefits of Preserving Consumers’ Ability to Compare Airline Fares." Skift.Com, 19 May 2015, skift.com/wp-content/uploads/2015/05/CRA.TravelTech.Study_.pdf.

[4] Stewart, James B. "'Discipline' for Airlines, Pain for Fliers." Nytimes.Com, 11 Jun. 2015, www.nytimes.com/2015/06/12/business/airline-discipline-could-be-costly-for-passengers.html.

[5] Stewart, James B. "'Discipline' for Airlines, Pain for Fliers." Nytimes.Com, 11 Jun. 2015, www.nytimes.com/2015/06/12/business/airline-discipline-could-be-costly-for-passengers.html.

[6] Hoover, Gary. "America’s Largest Airlines 1950-2019 in Two Animated Charts." Americanbusinesshistory.Org, 12 Jun. 2021, americanbusinesshistory.org/americas-largest-airlines-1950-1980-in-two-animated-charts/.

[7] Scott Morton, Dr Fiona, et al. "Benefits of Preserving Consumers’ Ability to Compare Airline Fares." Skift.Com, 19 May 2015, skift.com/wp-content/uploads/2015/05/CRA.TravelTech.Study_.pdf.

[8] Scott Morton, Dr Fiona, et al. "Benefits of Preserving Consumers’ Ability to Compare Airline Fares." Skift.Com, 19 May 2015, skift.com/wp-content/uploads/2015/05/CRA.TravelTech.Study_.pdf.

[9] French, Sally. "Why Southwest Should Allow 3rd-Party Airfare Search." Nerdwallett.Com, 16 Feb. 2023, www.nerdwallet.com/article/travel/why-southwest-not-on-google-flights.

[10] Palma, Kristi. "JetBlue’s Northeast Alliance with American Airlines Is Winding down. Here’s the Impact on Travelers." Boston.Com, 14 Jul. 2023, www.boston.com/travel/flights/2023/07/14/jetblue-american-airlines-northeast-alliance-shutdown/.

[11] Lisauskaite, Vyte. "Judge Gives American Airlines and JetBlue More Time to End the Northeast Alliance." Simpleflying.Com, 12 Jun. 2023, simpleflying.com/judge-gives-american-airlines-jetblue-time-end-northeast-alliance/.

[12] Casey, David. "Analysis: Unpicking the Northeast Alliance." Aviationweek.Com, 23 May 2023, aviationweek.com/air-transport/airports-networks/analysis-unpicking-northeast-alliance.

[13] Singh, Rajesh K., and Diane Bartz. "Analysis: Will Abandoning American Help JetBlue's Spirit Merger? Not by Much." Reuters.Com, 6 Jun. 2023, www.reuters.com/markets/deals/will-abandoning-american-help-jetblues-spirit-merger-not-by-much-2023-07-06/.

[14] Bailey, Jack . "What Exactly Is A Ghost Flight?" SimpleFlying.Com, 17 Nov. 2022, simpleflying.com/what-exactly-is-a-ghost-flight/#:~:text=A%20ghost%20flight%20is%20when,most%20precious%20assets%20%2D%20airport%20slots.

[15] Bailey, Jack . "What Exactly Is A Ghost Flight?" SimpleFlying.Com, 17 Nov. 2022, simpleflying.com/what-exactly-is-a-ghost-flight/#:~:text=A%20ghost%20flight%20is%20when,most%20precious%20assets%20%2D%20airport%20slots.

[16] Klower, M, et al. "Quantifying Aviation's Contribution to Global Warming." IOPscience.Iop.Org, 4 Nov. 2021, iopscience.iop.org/article/10.1088/1748-9326/ac286e#erlac286es2.

[17] "Google Flights, Denver to Colorado Springs." Google.Com/Travel, 9 Aug. 2023, www.google.com/travel/flights?safe=active&source=flun&uitype=cuAA&hl=en&gl=us&curr=USD&tfs=CAEQAhooEgoyMDIzLTA5LTAxagwIAhIIL20vMDJjbDFyDAgCEggvbS8wMXZzbBooEgoyMDIzLTA5LTAzagwIAhIIL20vMDF2c2xyDAgCEggvbS8wMmNsMXpoQ2pSSU1WVnZNMDFzTTBadmFEUkJRVVkwTFVGQ1J5MHRMUzB0TFMwdGNHWmlZbVl5TlVGQlFVRkJSMVJLV1RRd1FYTmhOVlZCRWdOdVZVRWFDd2lReXdFUUFob0RWVk5FT0RCd2tNc0I%3D&ved=2ahUKEwiM-JGan7yAAxXgMjQIHZXEAC0Qlhd6BAgNEDA.

[18] Ritchie, Hannah. "Which Form of Transport Has the Smallest Carbon Footprint?" OurWorldInData.Org, 13 Oct. 2020, ourworldindata.org/travel-carbon-footprint.

[19] Ritchie, Hannah. "Which Form of Transport Has the Smallest Carbon Footprint?" OurWorldInData.Org, 13 Oct. 2020, ourworldindata.org/travel-carbon-footprint.

[20] Parsons, Matthew . "Trains, Not Planes, Are Increasingly Business Travelers’ Preferred Choice in Europe." Skift.Com, 17 Apr. 2023, skift.com/2023/04/17/trains-not-planes-are-increasingly-business-travelers-preferred-choice-in-europe/#:~:text=TravelPerk%2C%20which%20is%20headquartered%20in,the%20same%20period%20in%202019.

[21] "Summary: H.R.2926 — 107th Congress (2001-2002)." Congress.Gov, 21 Sept. 2021, www.congress.gov/bill/107th-congress/house-bill/2926#:~:text=Air%20Transportation%20Safety%20and%20System%20Stabilization%20Act%20%2D%20Title%20I%3A%20Airline,1)%20issue%20Federal%20credit%20instruments.

[22] Nankin, Jesse, et al. "History of U.S. Gov't Bailouts." ProPublica.Org, 8 Sept. 2008, www.propublica.org/article/government-bailouts.

[23] "$63 Billion to Keep Aviation Workers Employed. Here Are the Numbers." PandemicOverisht.Gov, 17 Mar. 2022, www.pandemicoversight.gov/news/articles/63-billion-keep-aviation-workers-employed-here-are-numbers.

[24] Shepardson, David. "U.S. Airlines to Defend $54 Billion COVID-19 Government Lifeline." Reuters.Com, 15 Dec. 2021, www.reuters.com/business/aerospace-defense/us-airlines-defend-54-billion-covid-19-government-lifeline-2021-12-15/.

[25] Gluss, Susan, and Mary Boyle. "New Health Care Study: Public Option Would Generate More Benefits, Savings than Projected." Law.Berkeley.Edu, www.law.berkeley.edu/press-release/new-health-care-study-public-option-would-generate-more-benefits-savings-than-projected/.

[26] Friedman, Milton. "A Friedman Doctrine‐- The Social Responsibility of Business Is to Increase Its Profits." NYTimes.Com, 13 Sept. 1970, www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html.

[27] Arnold, Kyle. "Airlines Are Finally Admitting Contrails Are an Environmental Problem." PHYS.Org, 9 Dec. 2022, phys.org/news/2022-12-airlines-contrails-environmental-problem.html.

[28] Walt, Vivienne. "A Top CEO Was Ousted After Making His Company More Environmentally Conscious. Now He's Speaking Out." Time.Com, 21 Nov. 2021, time.com/6121684/emmanuel-faber-danone-interview/.

[29] Nunno, Richard. "Fact Sheet | High Speed Rail Development Worldwide." EESI.Org, 18 Jul. 2019, www.eesi.org/papers/view/fact-sheet-high-speed-rail-development-worldwide.

[30] "Frequently Asked Questions about Investing in Air New Zealand." AirNewZealand.Com, www.airnewzealand.com/investor-centre-frequently-asked-questions.

[31] "Shareholders." Investors.Finnair.Com, investors.finnair.com/en/shareholders.

[32] "Malaysia Airlines Berhad." CentreForAviation.Com, centreforaviation.com/data/profiles/airline-groups/malaysia-airlines-berhad#:~:text=MAB%20is%20owned%20entirely%20by,Firefly%20(since%20Apr%2D2007).

[33] "China Southern Air Holding Company." CentreForAviation.Com, centreforaviation.com/data/profiles/airline-groups/china-southern-air-holding-company.

[34] "Company Profile." AirNewZealand.Com, www.airnewzealand.com/corporate-profile.

[35] Statista Research Development. "Air China Group: Number of Air Passengers 2010-2020." Statista.Com, 3 Feb. 2023, www.statista.com/statistics/1286954/passenger-number-of-air-china/.

[36] Curran, Andrew. "Which Airlines Are Best Positioned To Survive COVID-19?" SimpleFlying.Com, 9 Sept. 2020, simpleflying.com/which-airlines-are-best-positioned-to-survive-covid-19/.

[37] Nueman, Scott. "Government Sells Last Shares In GM, Loses $10 Billion." NPR.Org, 9 Dec. 2013, www.npr.org/sections/thetwo-way/2013/12/09/249815202/government-sells-last-shares-in-gm-loses-10-billion.

[38] Smith, Aaron. "GM Stock Falls below $1." Money.CNN.Com, 29 Jun. 2009, money.cnn.com/2009/05/29/news/companies/GM_stock/index.htm.

[39] Woodall, Bernie. "GM Shares Drop to near IPO Price of $33." Reuters.Com, 10 Apr. 2014, www.reuters.com/article/us-gm-recall-shares/gm-shares-drop-to-near-ipo-price-of-33-idUKBREA3A02720140411.

[40] Seitz, Jacob. "Southwest’s History of Lobbying against High-speed Rail Surfaces in Wake of Flight Cancellation Fiasco." DailyDot.Com, 28 Dec. 2022, www.dailydot.com/debug/southwest-airlines-cancellations-high-speed-rail-lobbying/.

Super interesting! Great read

The Left wants the Post Office to run an airline.