Tech Oligarchs Have A Solution To The AI Bubble — You.

The revolutionary promises of AI were lies. So, tech oligarchs are shoving AI into your everyday life — while leaving taxpayers with the bill.

The latest Artificial Intelligence craze launched with promises to revolutionize life as we know it. Google CEO Sundar Pichai called AI more “profound to humanity than electricity or fire.” Forbes claimed it would end world hunger and stabilize the climate. McKinsey wanted us to think of AI as the fourth industrial revolution, or “4IR,” in tech speak. In March, Derek Thompson and Ezra Klein published Abundance, which predicted AI would be so transformative that its profits would be socialized by 2050. Earlier this year, futurist Ray Kurzweil praised the technology as the key to immortality, while OpenAI CEO Sam Altman said AI agents would “join the workforce” by 2026.1

As you are aware, none of these predictions came true, and those that have yet to reach their dates appear further away than ever. Google is no Prometheus. Progress in solving world hunger has stalled for a decade. Silicon Valley might think it delivered an Industrial Revolution, but future historians, whose judgement is uninfluenced by seed rounds and k-holes, are unlikely to include poorly rendered pictures of Mickey Mouse bombing Iran on par with the steam engine, telegraph, or modern agriculture techniques. Only nine months after his book launched, Derek Thompson has backed off the promise of AI socialism and is now saying the technology will write art better than humans. Quite the change in expectations, and still, a hollow promise that AI will eventually be beneficial, but not today. As for Mr. Kurzweil, time will tell. Literally. He’s 77, so I hope for his sake that AI achieves God Mode and defeats death sooner rather than later.

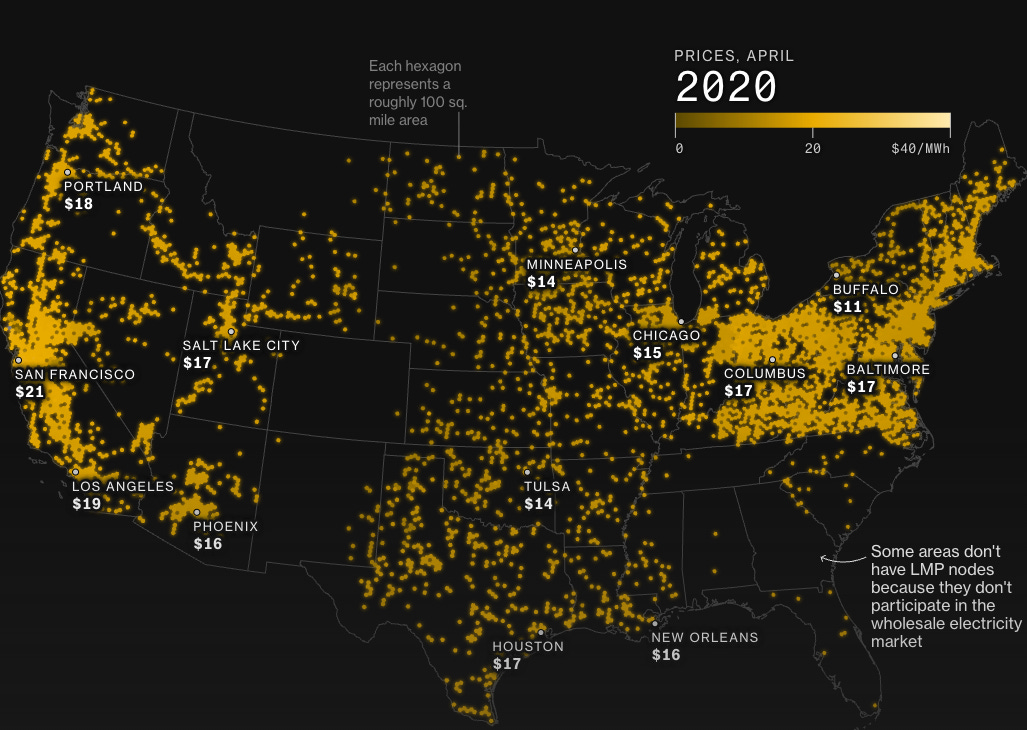

While the utopian uses of AI are imaginary, its harms are real. Wholesale electricity costs have increased as much as 267% in areas with AI data centers. In some cases, AI chatbots are encouraging young people to commit suicide. Putting aside the promises and investment pitches, Artificial Intelligence has delivered little good and a lot of harm to America. Yet, capital keeps investing, and the oligarchs’ media sycophants still claim AI-ushered utopia is only one more deregulatory bill away. Judging by reality, we don’t have an AI revolution. We have a bubble.

Economic bubbles emerge when speculators overinvest in overhyped products. Swayed by savvy marketers and technology they don’t understand, Wall Street pumps companies full of cash, driving stock prices to towering heights. But when the product’s actual value, measured by what consumers pay for it, is shown to be much lower than what investors thought, the bubble “bursts” and shareholders race to sell their stocks, hoping to get some return before the price falls to zero. When the internet emerged in the 1990s, any company with a website was considered an inevitable goldmine. Pets.com, an online pet store, was seen as the next big thing. It had a float in the Macy’s Thanksgiving Day parade, and its sock puppet mascot was ‘interviewed’ on Good Morning America. Two years later, when investors realized not everything with a website would be worth billions, the company went bankrupt, one of many victims of what is now called the Dot Com bubble. Though the AI bubble is vastly inflated by modern circumstances (for reasons we’ll cover later), large differences between the speculative value of a company (measured by its stock price) and the actual value of a company (measured by its sales) are not new. In the third volume of Capital, Karl Marx called these over-promised stocks fictitious capital.

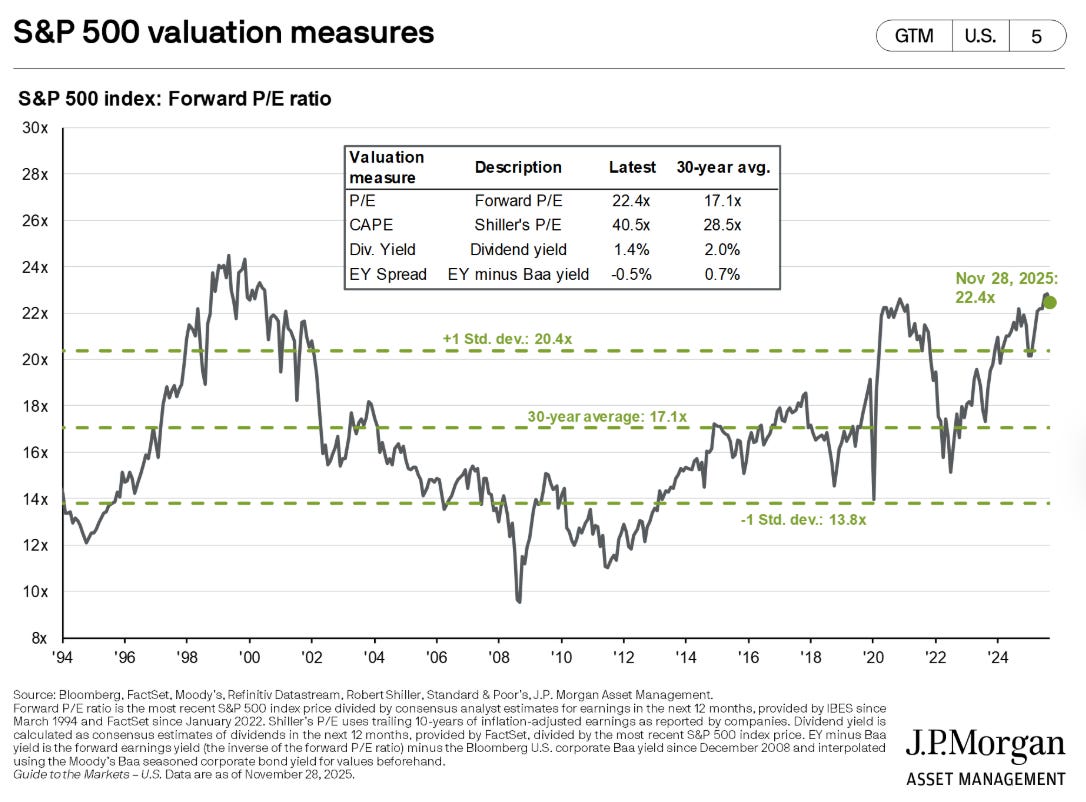

Currently, we’re sitting in the pre-pop stages of the AI bubble. The above claims about AI by tech oligarchs range from overpromises, to delusions, to lies that would make a Scientologist blush. The tales of infinite life and the reinvention of humanity worked well and attracted investment. I’d argue they worked too well. Now, the product can’t live up to the promises, and we’re starting to see signs. An AI startup called Thinking Machines recently achieved a $10B evaluation without showing investors a product or a plan. (People really invested billions in vibes alone.) Of the companies using AI, 95% of them haven’t seen a positive return, a subject of great concern at a manufacturing conference I recently attended. Most concerningly, the S&P 500 is trading at valuation levels only seen in the years before the Dot Com bubble burst (excluding the COVID collapse and spike).

This high valuation is driven by the seven largest tech companies, known as the Magnificent 7: Alphabet (Google’s parent company), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Over the last decade, the Mag 7, as they’re called, has tripled its share of the S&P 500, rising from 12.3% in 2015 to 35% in 2025. This group is so gargantuan that it equals the combined market cap (total value) of the Canadian, Japanese, and British stock markets. (Microsoft alone is worth more than Canada’s entire stock market.) The driving force behind the Mag 7’s value explosion is AI. Specifically, generative AI that creates content. If you’ve seen computer-generated images, videos, and other slop that dominate Facebook, you're familiar with generative AI. While this trend has generated enormous stock value for AI-leading companies, Wall Street’s patience is wearing thin. They were promised profitable revolutionary technology, not… Shrimp Jesus???

One J.P. Morgan analyst stressed that 2026 was the year tech companies needed to show “greater returns on AI investment” or else investors would flee. This is a reasonable request, given that less than half of AI projects are profitable. According to a new survey from Teneo, 53% of AI investors expect an ROI within the next six months; a timeline only 16% of tech CEOs think they can meet. Despite investors’ signals that it’s time to pay up, tech companies are planning heavy AI investment for next year, possibly even more than in 2025. What makes the AI bubble more concerning than previous tech bubbles has less to do with the product and more to do with the disturbing inequality in the American economy.

Income inequality has fueled stock investment. Arguably, America’s embarrassingly lopsided distribution of wealth is the main reason the AI bubble is being blown larger every day. Between 1946 and 1981, the top 10% of families received 32% of the nation’s pre-tax income. Since then, they’ve increased their share to 52%. With all that cash lying around, it’s a matter of time before they start looking for investment opportunities. Given the rich have so much and the working class so little, the top 10% of earners are responsible for half of all of America’s consumer spending. When the AI bubble bursts, the rich will pull back, and the economy will take an outsized hit. This dangerous imbalance isn’t normal. It’s the result of choices made by the American political elite. If we had a civilized economy with mechanisms to redistribute and predistribute wealth more equitably, the richest would account for a smaller share of consumer spending, making the impact of a stock market collapse less severe.

With investors growing tired of bullshit and recession indicators flashing (the latest jobs report shows unemployment at its highest in four years), one would think tech companies would pull back and focus on delivering profit with the infrastructure they’ve already built. But as Q3 earnings calls made clear, the Mag 7 will be stacking the cash-burning bonfire even higher in 2026. Given this, it would be reasonable to assume tech leaders are confident their AI products can live up to the earlier claims of industrial, medical, and technical revolution. However, the public appearances of leading AI figures shows they’re recalibrating expectations away from the pledges of real-life science fiction.

Last week, OpenAI CEO Sam Altman appeared on Late Night with Jimmy Fallon for what can only be described as a ChatGPT informercial: aided by a host hoping this is a stepping stone to the higher levels of show business, a salesman presented his product as a wondrous cure-all to the half-asleep audience. Laughs were sparse, the rehearsed Q&A was stale, and clapping was only heard when the painful ordeal ended.

Gone was the rhetoric of an AI revolution. Altman didn’t talk about computerized workers elevating the American economy, nor did he echo industry comments that his company was the vanguard of futurism. Instead, he described ChatGPT as a “general-purpose life advisor” and claimed it helped him raise his newborn. (I’ll bet OpenAI’s over-inflated value that a team of nannies, not a chatbot, raised Altman’s child.) The shift in positioning of AI from the future guarantor of human wellbeing to a slightly more effective Google search shows tech oligarchs are feeling the squeeze. Investors didn’t hand Sam Altman billions for an updated version of Ask Jeeves, but that’s what they’ve gotten. Simple questions make up 49% of ChatGPT queries. Attempting to show his financiers they haven’t completely wasted their money, the new AI strategy is to increase the user base. To do that, OpenAI, Google, Apple, and every other member of the Mag 7 is trying to convince everyday people like you and me that AI is a necessary part of our daily routine. Altman told Fallon he “couldn’t imagine” raising a baby without ChatGPT, encouraging new parents to outsource humanity’s most natural and practiced function to a computer. He also articulated a whole other set of everyday use cases, such as generating questions to ask your doctor — which he claims is ChatGPT “curing health conditions” — and an embarrassing story of how he consults the bot for social advice at parties. Peak ludicrosity was achieved when Altman claimed ChatGPT was “an equalizing force” between the rich and poor. Fallon, always eager to launder problematic causes to his audience, suggested ChatGPT “helps poor people get the same answers that rich people get from their lawyers, doctors, and business managers.” This is obviously false, as any lawyer, regardless of their hourly fee, will tell you not to use ChatGPT as your fucking lawyer, unless you have an unquenchable desire to see the inside of a federal penitentiary.

Uncoincidentally, the interview aired right as OpenAI was finalizing a licensing deal with Disney that will let users “generate short, user-prompted social videos that can be viewed and shared by fans, drawing on more than 200 Disney, Marvel, Pixar, and Star Wars characters.” As mentioned above, Sam Altman began 2025 promising that AI workers would enter the job market and change labor dynamics as we know it. With a month left in the year, his product’s biggest announcement is that it can generate Cameo videos of Darth Vader fighting Iron Man as a gift for your nephew’s12th birthday. If you’re pissed about being lied to, imagine how the people who gave Sam Altman a billion dollars feel.

But it’s not just OpenAI repositioning for everyday use. While Sundar Pichai once claimed his AI products would “equal the discovery of fire” (lmfao), Gemini, Google’s AI product, is currently being advertised as a great way to catch up on Stranger Things. Maybe it does a better job of avoiding spoilers than Wikipedia, but the capability, target user, and revenue model is entirely different from how Google’s CEO discussed AI just a few years ago.

This isn’t to say AI companies are abandoning their futuristic aims completely. Altman ended his late night appearance claiming ChatGPT will “cure diseases” within five years. And Vox, which recently announced an Abundance-style editorial slant funded by AI investor Arnold Ventures, is trying to reset expectations on AI by claiming it “generates new ideas,” which apparently, scientists have run out of. The capitalists aren’t even promising us specific problems AI will solve. The best they can muster is, “Trust us bro, this is definitely worth your higher electricity bill. Scientists can think again!” But if this push to attract individual consumers fails to fill the ever-expanding bubble, our genius tech overlords have a backup plan ready to go — commence Operation Sugar DAIddy.

Over the last few months those most heavily invested in AI have not-so-subtly suggested it might be time for a good old’ fashioned government bailout. Sam Altman went on a podcast and outlined his vision for AI, saying the government will be the “insurer of last resort.” Not long after, OpenAI’s Chief Financial Officer spoke at a Wall Street Journal event that the federal government should be a “backstop” and take on AI companies’ debt.

“ When something gets sufficiently huge, the federal government is kind of the insurer of last resort, as we’ve seen in various financial crises. Given the magnitude of what I expect AI’s economic impact to look like, I do think the government ends up as the insurer of last resort.”

As someone whose day job is to get tech executives to talk about their product with a unified voice, I can confidently say this is no accident. In OpenAI’s boardrooms, it’s been discussed that a likely path to break-even (never mind profit) is to ask for Uncle Sam’s wallet. We should take note that the executives feel the need to lay the groundwork sooner rather than later.

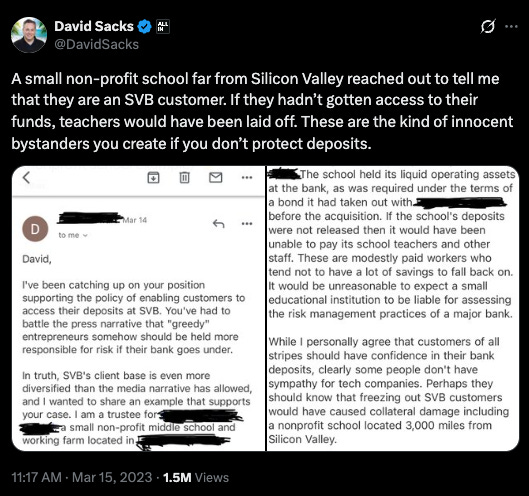

While the Trump administration has denied the possibility of a bailout, their word isn’t exactly trustworthy nowadays. Especially given who is calling the shots. David Sacks, the White House’s AI and Crypto Czar, is a venture capitalist heavily-invested in both. Sacks fancies himself a small-government libertarian, but after his bank, Silicon Valley Bank, lost $42 billion in a single day, Sacks begged for and received a federal bailout. Now, he has the ear of a president who has no problem manipulating economic data to avoid negative press. With one word from Sacks, or any of the other administration officials openly enriching themselves through public service, Trump will undoubtedly sign a bailout package that sends tax payer money directly into the Magnificent 7's bank accounts, ensuring the rich get richer off the back of the working class.

Artificial Intelligence is not the first bubble, and it won’t be the last. Whenever capitalists have more money than they know what to do with, they’ll throw it into the hottest snake oil industry in hopes of a return. But what is different about the AI bubble is that the richest, most powerful people are the ones currently holding the bag. Except for tech workers, most Americans don’t have direct skin in the AI game, like they did when the housing bubble burst in 2008. But that doesn’t mean we’ll get out unscathed. The Trump White House is tight with the tech world, and I’m not sure which has less regard for ethics and basic human decency. When the AI bubble begins to burst, and I do consider it a “when” rather than an “if,” Google, OpenAI, Microsoft, and every other financial entity that invested in the Emperor’s Magical Invisible Cloak LLC. will undoubtedly push for taxpayers to pay for their rich asshole idiocracy. Americans aren’t going to like that, and I wager a potential AI bailout will be an issue in coming elections.

But fear not, Sam Altman. I have a solution for you to eliminate your debt and make Artificial Intelligence profitable. Just ask ChatGPT. If it’s the next stage of evolutionary intelligence, this should be an easy solve. Right?

Thanks for reading! If you appreciated this article, please click the❤️ and don’t forget to subscribe so future articles are delivered to your inbox. If you’re a returning reader, please consider a supporting subscription. It only costs one cup-of-coffee a month and gets you access to exclusive bonus content, as well as ensuring I can continue creating content like this. Thanks in advance!

In Solidarity — Joe

Credit to Freddie deBoer for pointing out how far the goalposts have shifted on AI.

I think all these datacenters aren't being built for generative AI, they're built for surveillance AI. So yeah, we'll bail them out somehow, most likely through government contracts.

In the 1950s we were promised a 30 hrs work week and higher wages. Didn't happen. Tech bros are in that same church, different pew. If there are profits to be had, the oligarchs will get tĥem.