Last week conservative commentator and aspiring musician/novelist/screenwriter Ben Shapiro stated he doesn’t believe in retirement. Yup, you read that right.

"No one in the United States should be retiring at 65 years old. Frankly, I think retirement itself is a stupid idea unless you have a health problem."

The tirade was part of a monologue claiming Social Security (and to a lesser degree Medicare) are fiscally unsustainable. As Ben argues, when the Social Security retirement age of 65 was established during the New Deal, the average life expectancy was 63. Today, life expectancy is close to 80. According to this podcaster who has never worked a day in his life, it is “crazy talk” to continue paying Social Security benefits at age 65 when Americans live much longer.

While Shapiro’s brutally honest admission that Americans should work until they die shook many, he’s not alone in this view. Dissembling Social Security remains a top priority of the conservative movement and the Republican Party. Now-defeated Presidential candidate Nikki Haley wants to “reform” social security by cutting it for young people while preserving it for elderly voters. When the Koch network backed the Haley campaign, they praised her for advocating changes to “an entitlement system (Social Security) that makes promises it can’t keep.” Similar arguments for cutting America’s most popular social program can be found in National Review, The Wall Street Journal, and other prominent conservative publications. (Which is weird, because I’ve been told the Republicans are now a “working-class party.” 🤔)

The Argument for Cutting Social Security

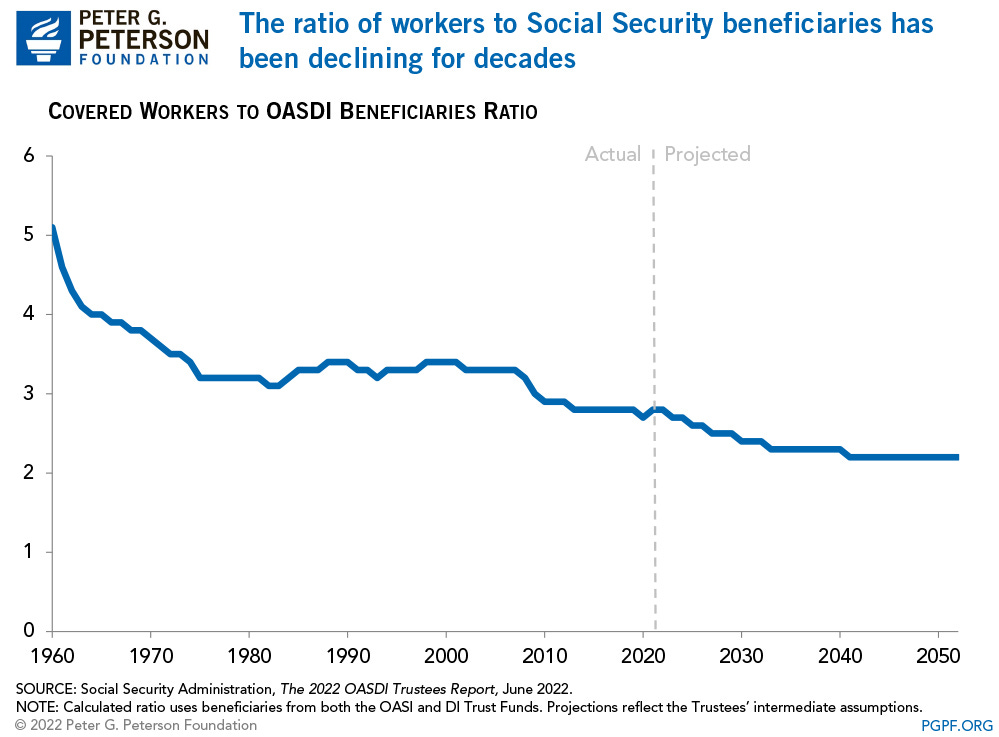

In a vacuum, conservatism’s argument for cutting social security makes sense. When the program began in 1935, there were approximately 42 workers per retiree. This meant that for every American taking money out of social security, 42 Americans paid into it. But as modern Americans have fewer children and live longer, this ratio has fallen. According to the conservative Peter G. Peterson Foundation, the current ratio is 3 workers for every 1 retiree, and it’s projected to fall to 2 workers per 1 retiree by 2050.

Since 2020, when tax revenue fell due to the COVID-caused recession, Social Security has cost more than it brings in. Current predictions have the Social Security trust funds (Social Security savings accounts) projected to run out in 2035. When they do, a trigger law will kick in restricting social security to distributing only what it brings in via taxes. If this trigger law does take effect, it will reduce benefits by approximately 23%, a devastating cut for the 70.6 million disabled and retired Americans who rely on the program.

Fortunately, these cuts are not inevitable. With one simple fix, we can ensure Social Security remains solvent for generations.

And The One Weird Trick to Save It

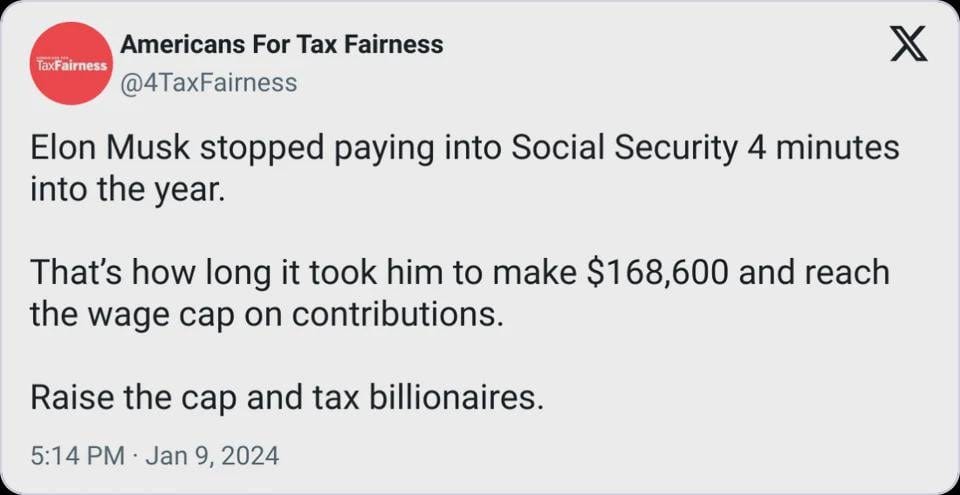

Today, Americans pay 6.2% of their wages into Social Security, which their employer matches. However, Social Security has a taxable maximum income yearly adjusted against the national average wage index. Any dollar an American makes over that maximum is untaxed by Social Security. In 2024, the taxable maximum is $168,600. So, if an American makes exactly $168,600 in annual wages, they would pay $10,453.20 into Social Security, as would their employer.

But here’s the catch.

Because social security can’t tax any income over that amount, $10,453.20 is the most any American — including the ultra-wealthy — will pay into the program. This means a person who makes $168,000 a year and a person who makes $168,000,000 a year pay the same amount in Social Security taxes. This is, to use a technical phrase, utter bullshit.

What’s more ridiculous is that given how the wealthy can hire expensive accounts to navigate the tax code, they are likely paying less than the taxable maximum demands. When Pro Publica conducted a study into the true tax rate of the world’s richest people, they found that in 2011, Jeff Bezos reported a net loss income. He even received a $4,000 child tax credit for his children, as in the eyes of the government, he was “poor.” In reality, his total wealth hovered around $18 billion, yet he didn’t pay a dime in Social Security taxes.

Given I have no reason to doubt conservatives’ claims that, if Social Security’s retirement age and benefit allocation remain constant, it will become insolvent within the next two decades, eliminating the taxable maximum is the obvious solution.

In 2022, Social Security allocated $1.2 trillion in benefits to Americans. That same year, American gross national income (the total money earned by Americans and their businesses) was just under $26 trillion. If all of that had been taxed at the standard 6.2%, instead of just $168,600 per earner, Social Security would have accrued $1.6 trillion, a $400 billion surplus. The excess funds could have been saved in the trust funds for deficit years, allocated as benefits, or returned to taxpayers. As eliminating the taxable maximum cap would put social security in a strong financial position despite the current 3:1 worker-to-recipient ratio, we can see how this simple change would secure America’s most coveted program for generations.

So if this solution is so simple, why are rightist pundits like Ben Shapiro not suggesting it? Basic familiarity with conservatism tells us it’s because they don’t want to save Social Security. As Ben put it so elegantly, conservatives want you to work until you die. Eliminating social security forces elderly and disabled Americans into work, loosening the labor market so capitalists can pay lower wages and increase profits.

Don’t be fooled by the right’s smoke and mirrors about the “fiscal irresponsibility” of Social Security. Eliminating the taxable maximum is a simple solution to ensure Americans of every age can retire with dignity. Conservatives don’t acknowledge this easy fix because they don’t want you to retire. They want you to man their friends’ factories and assembly lines until you keel over, at which point they’ll throw your body in the trash and replace you with their next victim.

Make sure you subscribe to the email list so future articles are delivered straight to your inbox. You can also support my work by liking this article (click the heart button) and forwarding it to a friend.

To dissemble is to lie or disguise your true intentions . To disassemble is to take something apart. While conservatives dissemble often, they’ve made no secret of their intentions to disassemble social security.

A fine solution for taxing the wealthy, but it's a shame you premise is based upon such faulty, outdated reasoning. A country with a sovereign currency can never become insolvent. It can always meet its obligations. Funding SS is a political issue, not an economic one. Please take 5 minutes to read something about MMT (modern monetary theory). It will prevent idiotic discussions about 'running out of money.'