Republicans Don't Hate Social Security Because It's Broken — They Hate It Because It Works.

A successful social program undercuts the conservative worldview.

Social Security is a problem for conservatives. As their worldview believes that government is inept and will always produce worse outcomes than the Free Market™️, a highly popular and successful public program is a thumb in their eye. It’s challenging to argue that America can’t have a social democratic welfare program when elderly Americans are happy with their social democratic welfare program. Ever since FDR introduced Social Security in 1935, the Republican party (and some Democrats) have been trying to destroy it. But after ninety years of proven success keeping retirees out of poverty, Social Security is too popular for the GOP to kill outright.

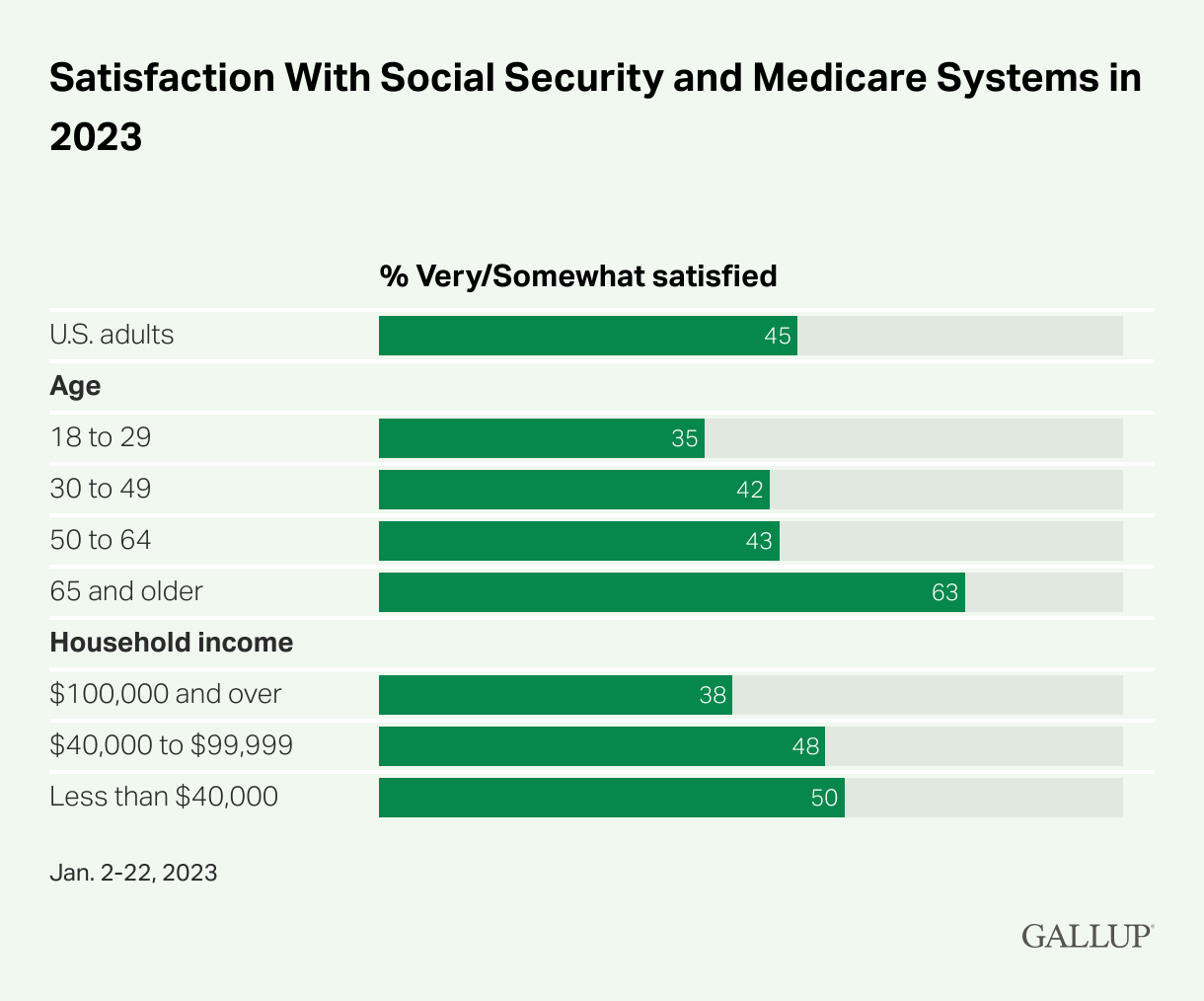

87% of Americans believe Social Security should remain a priority for America regardless of budget deficits.1 Even more interesting is that Social Security is most popular with the Americans who use it. A 2023 Gallup poll found that 63% of Americans over 65 were either very or somewhat satisfied with the current state of Social Security. That’s a higher approval rating than amongst Democrats (52%).2 The reason for this is simple. Not yet retired, Americans under age 65 have consistent income through their jobs. To them, Social Security is just another abstract political issue. It’s argued about in op-ed pages, decried on Fox News, and championed on MSNBC. Every time they consume political content, whether legacy newspapers or TikTok videos, they’re told that Social Security is controversial, will run out, and needs serious reform. This is not the experience of seniors who receive Social Security payments. While they consume political media (often at higher rates than their younger counterparts), seniors don’t think about Social Security — they experience it. Last year, 60% of retirees said Social Security was a major source of income, the highest in over a decade.3 When retired Americans sit down at the kitchen table to pay the monthly bills, the Social Security check covers the balance. It keeps them fed, clothed, and sheltered. Without it, they’d be forced back into the labor market, where they must work for lower wages to compete with younger Americans, who are more valuable to an employer. Unsurprisingly, many of them would endure economic hardship. According to the Center on Budget and Policy Priorities, if not for Social Security, 37% of Americans over 65 would be below the poverty line.4 It’s no exaggeration to say this is a life-saving program.

Because Social Security is popular with seniors, who lean Republican, the GOP can’t end the program outright. Doing so would lose them more elections than ISIS in Texas. So, they employ the subtle sabotage plan commonly used by right-wing forces. First, they delay, defund, and irritate the government service until it’s effectively useless. Once the public is angry about the poor quality, whether it's late public buses or delayed entitlements payments, conservatives are there to offer their favorite “solution” — privatization.

“Social Security is in pretty good shape despite what everybody screams about. But if you can defund it, it won't be in good shape. And there is a standard technique of privatization, namely defund what you want to privatize. Like when Thatcher wanted to defund the railroads, the first thing to do is defund them, then they don't work, and people get angry, and they want a change. You say okay, privatize them, and then they get worse. That’s the standard technique of privatization: defund, make sure things don’t work, people get angry, you hand it over to private capital.” — Noam Chomsky, The State-Corporate Complex: A Threat to Freedom and Survival (2011)

While previous Republican presidents were open about this strategy (George W. Bush tried to privatize Social Security in 2005), Trump recognizes the liability cutting Social Security, Medicare, and Medicaid brought the GOP. While he repeatedly claimed he would protect entitlement programs on the campaign trail (below), President Trump sings a different tune. While he won’t outright say he wants to cut Social Security, that is his intention.

As you can probably tell from the constant discussion of Social Security from elected Republicans, they’re employing the exact strategy Chomsky outlined above. To his credit, Trump r

During his Tuesday speech to Congress, Trump echoed Elon Musk’s lie that Social Security is rife with fraud. By claiming there were “4.7 million dead people receiving Social Security,” Trump laid the groundwork for DOGE to gut the program under the pretext of finding non-existent thieves. In reality, only 89,106 Americans over ninety-nine are collecting benefits.5 I know this because the Social Security Administration (SSA) publicizes its information. This isn’t a secret, nor is it a debatable opinion. It’s a fact. Either Trump and the DOGE shitheads can’t read (not an unlikely possibility) or they’re lying to you.

This lie was further debunked by Trump’s own Social Security Administration. On February 19th, acting director Mark Hinkle released the statement below.

“I want to acknowledge recent reporting about the number of people older than age 100 who may be receiving benefits from Social Security. The reported data are people in our records with a Social Security number who do not have a date of death associated with their record. These individuals are not necessarily receiving benefits.6

Trump will still tell MAGA rallies he’s not cutting Social Security, and they’ll cheer like he just announced the public execution of an abortion doctor. However, sensible observers should call this for what it is: Trump is attempting to shift his previous pledge not to cut Social Security into the long-standing conservative desire to end it. He can’t say he’ll end the program without upsetting his supporters, so he waxes poetic about fraud and theft to disguise the destruction of Social Security as an attempt to save it. While the average GOP talking points might not be as outlandish as Trump's, they’re equally deceitful, about as reliable as Trump’s golf “accomplishments.”

The most common Republican attacks on Social Security are:

Social Security will “run out” in 2035,

There are not enough workers to support recipients, and

It’s better for workers to invest privately than to pay into Social Security.

Let’s start with the big one, claim #1.

Social Security is not going to “run out.” The program is financed by a 6.2% tax on workers and employers, which you see on your pay stub. As long as that tax exists, recipients will still receive benefits. When conservatives talk of Social Security “running out,” they’re referring to the Social Security Trust Funds. The taxes you pay (and any other income from the SSA) are deposited in one of the two trust funds: one for old-age retirees and one for disabled Americans. When there’s money in the trust fund that is not needed in the current year, excess revenue is invested in Treasury bonds guaranteed by the U.S. Government. When the bonds mature or they’re required to pay benefits, the SSA cashes them in. According to the SSA’s 2024 Trustee Report, the trust funds will become insolvent by 2035 if Congress chooses not to act. If that happens, retirees will receive 83% of their current benefits.7 Losing 17% of your income will bring hardship to America’s seniors, but it’s certainly not going to collapse the Social Security program.

Before I spell out how Congress can easily prevent this 17% benefit loss, let’s explore conservative argument #2, the claim of the imbalanced worker-retiree ratio.

As life expectancy has increased since 1935, Americans receive Social Security benefits for longer than when the program was created. This creates a diminishing ratios between workers paying in and retirees collecting benefits. In 1940, forty-two workers paid into Social Security for every one recipient. Today, that ratio is three workers for every one recipient, and it’s projected to be two-to-one by 2050.8 Conservatives point to the shrinking ratio and claim, “See! Social Security is going to collapse!” Elon Musk made this argument on a recent appearance The Joe Rogan Experience, America’s leading economics and science podcast.

Much like the claims that Social Security will expire, this is disingenuous and ignores the very obvious solution. The worker-to-recipient ratio will only be a problem if — you guessed it — Congress doesn’t fix it. It’s ridiculous to expect the Social Security Act of 1935 to fit perfectly into contemporary problems, just as it’s nonsensical to believe any century-old act would never require adoptions for modern times. We’ve amended the Constitution eight times since then, changed budget priorities every year, and added additional entitlement programs to address contemporary needs. It’s a testament to Social Security’s effectiveness that the so-called expiration date is a century after it was created. I’m unaware of any program, private or public, that has a hundred years of effective operation without needing serious changes.

The reason conservatives ignore the obvious answer that Social Security requires a small update to avoid problems #1 and #2 is because not solving the problems is the only way they can destroy it. As you notice, Republicans’ claims about Social Security are exclusively forward-facing: “This is going to happen,” or “We’re headed for disaster!” Unlike Obamacare or inflation, they can’t point to a breakdown of Social Security, because there isn’t one. With no victim they can invite to a press conference, they plug their ears and scream “I can’t hear you” as we explain the very simple update that would end the problems they claim to care about.

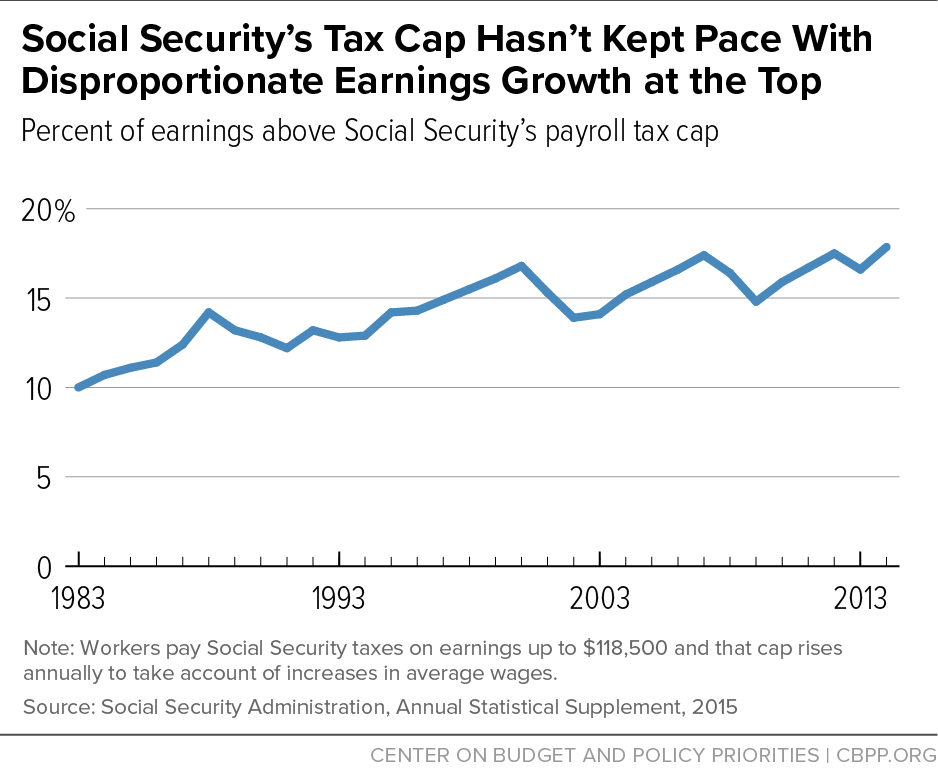

And that’s all Social Security needs: an update. Under current law, the Social Security tax rate is 6.2% for employees, capped at $10,918.20 annually. This translates to a maximum taxable income of $176,100, which means an American making $176,100 and one making $1,760,100,000 pay the same amount into Social Security ($10,918.20). To illustrate how insane this is, Elon Musk stopped paying Social Security taxes at 12:15 a.m. on January 1st.9 He crossed the taxable max of $176,000 fifteen minutes into the New Year, and not a single penny made after that goes to supporting the American working class. Because of this cap, Social Security is a regressive tax. Someone making the median income of $40,000 a year pays 6.2% of their wealth into Social Security, while a soulless ghoul who makes a billion dollars pays .00001% of their annual income. To make you even madder, Social Security does not tax income made from capital (interest and dividends on stock investments) a common income stream for the rich. That’s called Freedom and it only exists in America.

To fix this absurdity and ensure that Social Security can continue providing benefits for disabled and retired Americans, Congress only has to repeal the taxable maximum and collect 6.2% taxes on everyone, regardless of income. Doing so would make the 229 wealthiest Americans pay the same into Social Security as 77% of all Americans. This change is more necessary than ever, as the percentage of total Americans’ earnings above the Social Security tax cap has steadily risen since 1983, the last time Congress addressed this question.

Projections show that removing the taxable cap would solidify Social Security for decades, at the minimum. A 2022 report from the nonpartisan Congressional Budget Office found that removing the cap on income over $250,000 would generate $1.2 trillion in revenue over nine years and keep the trust fund solvent through 2046.10 This plan didn’t tax income between the current cap ($176,100) and $250,000, so including that would lengthen solvency. This is only one available option. When Senators Bernie Sanders and Elizabeth Warren asked the SSA (another nonpartisan body) to forecast the impact of their 2022 Social Security Expansion Act, which would tax profit from capital and use the Consumer Price Index for the Elderly instead of the Consumer Price Index for Urban Wage Workers when calculating Social Security Cost of Living Adjustments, the SSA found those changes would expand benefits and sure up Social Security trust funds through at least 2096.11

What makes the refusal to raise the Social Security cap tax so infuriating is that it’s exactly what Congress did to fund Medicare. From its inception in the 1960s until 1993, Medicare Hospital Insurance (a.k.a. Medicare Part A) had the same tax structure as Social Security. Congress recognized this was leaving Medicare underfunded, so they repealed the taxable income cap to ensure the program could continue as designed. The below quote is from the Chicago Tribune covering the change in 1993.

“What the revised rules do is end the ceiling on the Medicare payroll tax for 1994 and later years. Instead, all salaries, commissions, bonuses, vacation pay, etc., are subject to Medicare taxes for employees and the self-employed, not just those up to a specific amount that is revised upward each year- $ 135,000 for 1993. However, there continues to be a cap on the amount of wages and net self-employment earnings subject to the Social Security tax of 6.20 percent.12

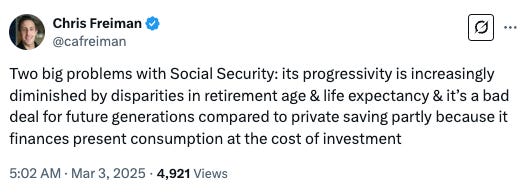

While these are the two most prominent attacks on Social Security, there are a handful of less-convincing arguments flying around the right-wing echo chamber. The claim that it would be better for workers to personally invest than contribute to Social Security, advocated here by a libertarian economics professor, forgets the reason Social Security exists in the first place.

Before FDR created Social Security, workers invested privately for their retirement. A portion of their weekly paycheck was saved in a bank, which would accrue interest until the cash was withdrawn at the end of their career. However, as Professor Freiman forgets, the banks crashed in 1929, leaving those who saved penniless. Social Security was the solution to the problem of personal investment, which carried risk. It’s a classic case of a right-winger arguing we should forget the lessons history taught us because it matches their unrealistic ideology. Not only is it not a worker’s fault if their life savings are deleted in a stock market crash, but it is bad for society to have 50% of their retirees (the senior poverty rate in 1935) begging on the street corner. If you need further proof of how terrible an idea ending Social Security for private investments is, Freiman tweeted it at 5 a.m. on March 3rd. A few hours later, the stock market opened and fell over 1,300 points in two days. I can’t think of a better warning about the dangers of banking your savings in Coca-Cola stock. Or crypto, as many libertarians suggest nowadays.

Unlike private investments, when a worker contributes to Social Security, that money is invested in Treasury bonds guaranteed by the U.S. Government. When you save for retirement through the stock market, you’re gambling. If things don’t go your way, so sorry — thanks for playing capitalism. Your consolation prize is a bed in an underfunded homeless shelter. But when you save through Social Security, you can go about your life with peace of mind, knowing a dignified retirement awaits. After all, Social Security has never missed a payment in ninety years of operation. It might seem odd that conservative critics want to cut a program with a century of consistent success supporting retirees. But to conservatives, Social Security’s success is not something to be improved — its precisely why they want to cut it.

For every mouth-breathing Republican who gets elected to Congress, there’s a hundred conservative lawyers and think tank writers crafting policy papers and legal challenges to end Social Security. The conservative movement wants to end Social Security not because it's unsuccessful but because it’s highly successful. Every time a billionaire-backed politician stands before the American people and says we must cut regulations and privatize social programs because the government is terrible at everything, Social Security is a tangible rebuttal. Not only is it actively keeping seniors housed and fed with a check they can put their hands on, but the program was specifically created to solve the failures of the free market. America tried to leave retirement to risky personal investments. It failed and threw the country into disarray. So, we instituted New Deal reforms that, while protecting capitalism, were systemic acknowledgments that the Free Market™️ was fallible and society required collective, government-designed solutions.

Social Security disproves every Daily Wire speaker rambling on college campuses, every Heritage Foundation white paper about capitalist supremacy, and every billionaire who says taxes should always go down (especially on themselves). As long as it exists, it will be a thorn in their side, cutting every conservative argument off at the knees. That is why Republicans hate Social Security, and why they must resort to lying about it. They won’t stop until its gone, even if that means tossing grandma out onto the cold, dark street.

Alternatively, the left argues the U.S. should take the lessons of Social Security and apply them to other aspects of society. Collective, centrally-planned programs are the answer to our modern housing, medical, and transportation problems. If you need proof this can work, just remember we’ve been delivering checks to every senior in the country since a decade before the computer was invented. So I’m confident modern technology can ensure no American goes hungry.

Thank you for reading JoeWrote! We’re a reader-supported media outlet that covers current events through a lens that mainstream publications ignore. If you enjoyed this article, please become a free or premium subscriber. Paid memberships keep the lights on, so if you like my work please consider upgrading.

As always, click the ❤️ button to help this post rise in Substack’s algorithm. Thanks!

In Solidarity — Joe

https://www.nirsonline.org/wp-content/uploads/2024/07/FINAL-Views-on-SS-July-2024.pdf

https://news.gallup.com/poll/470894/americans-fairly-satisfied-social-security-system.aspx

https://news.gallup.com/poll/1693/social-security.aspx

https://www.cbpp.org/research/social-security/social-security-lifts-more-people-above-the-poverty-line-than-any-other

https://www.ssa.gov/oact/progdata/benefits/ra_age202412.html

https://www.ssa.gov/news/press/releases/2025/#2025-02-19

https://www.cnbc.com/select/will-social-security-run-out-heres-what-you-need-to-know/

https://www.uvm.edu/~dguber/POLS21/articles/quick_facts_on_social_security.htm

https://www.forbes.com/sites/teresaghilarducci/2025/01/01/the-rich-stop-paying-social-security-tax-around-january-1/

https://www.cbo.gov/budget-options/58630

https://www.sanders.senate.gov/wp-content/uploads/SandersLetter-2023-0213.pdf

https://www.chicagotribune.com/1993/09/26/new-law-lifts-lid-on-medicare-tax/

Really good point about how active social security users have the highest support for the program. This reminds me of organizers for tenants’ unions. They don’t want the government to nudge the “free market” into building more housing - they want renters’ rights. Good problem solvers focus on the needs of users. It would be pretty cool if our political parties started acting like problem solvers.

Wonderful, clear article! But what do we do about these people? How do we stop them?